Client Retention: Why Keeping Customers Is as Critical as Getting Them

(5 Min Read)

Hi, it’s David Lambert, and welcome to The Business Growth Blueprint, my weekly newsletter where I delve into the critical elements of business growth—strategy, leadership, operations, and the technologies shaping tomorrow. Subscribe to join 2,300+ readers who get The Business Growth Blueprint delivered to their inbox every week.

Introduction

Note: I use client and customer interchangeably throughout.

Imagine this: your sales team lands a big new customer and celebrates, high-fives all around. Fast forward a few months: the customer slips away due to a service snafu, and everyone’s deflated. Sales is frustrated (“We worked so hard to win that deal!”) and operations is scrambling to figure out what went wrong.

The result: growth figures slide and sales often takes the blame, either for “selling a bad deal” and/or for failing to hit quarterly or annual targets that they would have achieved if the customer had been retained. If you’ve led a growth team or business unit, you’ve likely seen this play out. I know I have.

Client retention often doesn’t get the same fanfare as new sales, but it’s every bit as important to a company’s success. In this, I’ll explore why keeping clients is crucial, how good vs. poor retention impacts revenue and reputation, how client retention is measured, and what you can do to keep your hard-won customers around.

Please feel free to comment and subscribe - it’s free!

The High Cost of Losing Customers (and the Value of Keeping Them)

Focusing on client retention isn’t just a nice-to-have; it’s a smart business strategy with profound financial implications. Consider these eye-opening facts about existing customers vs. new ones:

It’s Cheaper to Keep ’Em: Acquiring a new customer can cost five times more than retaining an existing one. You read that right: all those marketing dollars, sales pitches, and onboarding efforts for a new client are five times pricier than simply keeping your current clients happy. No wonder retention delivers a better bang for the buck.

Small Changes, Big Payoff: Even a tiny increase in retention pays off hugely. According to multiple sources, for example, Bain & Company and analyses of customer-relationship data, increasing customer retention by just 5% can boost profits by an average of 60–65%, depending on the industry and cost structure. Loyal customers tend to buy more over time, which drives those profit gains. Repeat customers spend ~67% more on average than new customers. They’re also more open to trying your latest products and services (about 50% more likely, studies show). All that adds up to higher revenue/margins when you keep clients coming back.

Easier to Sell More: Existing customers are not only cheaper, they’re friendlier to your sales funnel. The success rate of selling to an existing customer is 60–70%, whereas for a brand-new prospect it’s as low as 5–20%. It makes sense that your current clients already trust you, so they’re more likely to say “yes” to that next offer. Meanwhile, a cold prospect might slam the door 9 times out of 10.

Despite these benefits, many businesses underestimate retention. One survey found that 44% of companies focus more on acquisition, while only 18% focus more on retention.

It’s like pouring water into a bucket with a hole in it: all the effort you put into winning new clients could be wasted if you're not taking care of your existing ones. Nearly half of B2B companies don’t even track their customer retention rates, which means they are unaware of a significant opportunity (or problem). The main point is that client retention deserves at least as much attention as acquiring new business.

Good Retention vs. Bad Retention: Impact on Revenue and Reputation

What happens when you retain clients effectively, and what happens when you don’t? Let’s compare the two extremes:

When Retention is Great

High client retention is a superpower for your business. For one, it leads to steady, predictable revenue. Loyal customers stick around, providing recurring sales you can count on each quarter. This makes budgeting and planning a whole lot easier; you’re not starting each month at zero. A base of committed clients can form the bulk of your profit; in many companies, the most loyal 20% of customers account for 80% of total profits.

Retention also fuels growth. Satisfied clients often expand their business with you (buying additional services or upgrades) and give referrals. Research shows loyal customers are 4 times more likely to refer a “friend”, essentially becoming unpaid brand ambassadors. They also tend to forgive occasional mistakes more easily (one study says loyal customers are 5x as likely to forgive a company’s error). And perhaps most importantly, happy long-term customers bolster your reputation. They provide positive reviews and testimonials, attracting new customers and enhancing your brand image. Think of brands known for fanatical customer loyalty like Amazon, Ritz-Carlton, or Netflix, and how their reputations benefit from armies of satisfied, retained customers. That loyalty translates into billions in repeat revenue.

When Retention is Poor

On the flip side, poor client retention is like a leaky bucket in your business. You might be winning new customers, but if they keep leaving, you’re essentially running in place or worse, falling behind. I’ve seen this happen. Losing customers hurts revenue in obvious ways: it’s revenue you had that’s now gone. But it also represents wasted acquisition cost and effort. U.S. companies collectively lose an estimated $83 billion a year due to poor customer retention and “switching” issues. If your sales team is pulling in clients only to see them churn, it’s demoralizing, and the money spent on marketing and sales gets flushed down the drain.

Poor retention also puts a cap on growth. Instead of growing your business, new sales are merely replacing the revenue lost to unhappy customers, a zero-sum game. Take a real example: Sweet Fish Media, a B2B podcast agency, realized they had a serious churn problem. They likened it to having “a big hole at the bottom of their bucket.” New business was pouring in, but 15% of their recurring revenue was leaking out every month due to customer attrition. That level of churn is unsustainable. Imagine losing 15% of your business monthly. They took action by implementing a retention strategy and proactively engaging clients, which reduced their monthly churn from 15% to just 3% within a year.

Beyond dollars, poor retention can damage your reputation. Customers who leave often don’t do so quietly, and they voice their frustrations. Approximately 13% of unhappy customers will share their experience with 15 or more people via tweets, rants to colleagues, scathing reviews, and so on. Negative word-of-mouth can tarnish your brand, making others wary of doing business with you.

And in today’s world, one viral bad review can snowball quickly. Why do customers bail? Often, it’s service or quality issues. A remarkable 72% of customers will switch to a competitor after a single bad customer service experience. Even one slip-up, a missed deadline, a rude support call, or a product that didn’t live up to promises can send a client packing. In short, poor retention not only cuts into revenue but can create a negative feedback loop for your brand image.

And let’s not forget internal reputation and morale: if your operations team can’t deliver what the sales team sold, it creates internal friction. Salespeople get frustrated seeing their hard-won deals flame out, and service teams feel constantly in firefighting mode. There’s also the proverbial “sales sold a bad deal”. It’s not a fun environment. High churn is a symptom of deeper issues, misaligned expectations, poor customer experience, or product/service gaps that everyone in the company ends up grappling with.

How to Measure Client Retention

Client and customer retention is typically measured by evaluating how well a company maintains its existing customer base over a given period. One of the most common and effective metrics is customer retention rate (CRR), which calculates the percentage of customers a business retains from the beginning to the end of a period, excluding new acquisitions.

The formula is: CRR = ((E − N) / S) × 100, where E is the number of customers at the end of the period, N is the number of new customers acquired during the period, and S is the number of customers at the start. This gives a clear picture of customer loyalty and satisfaction.

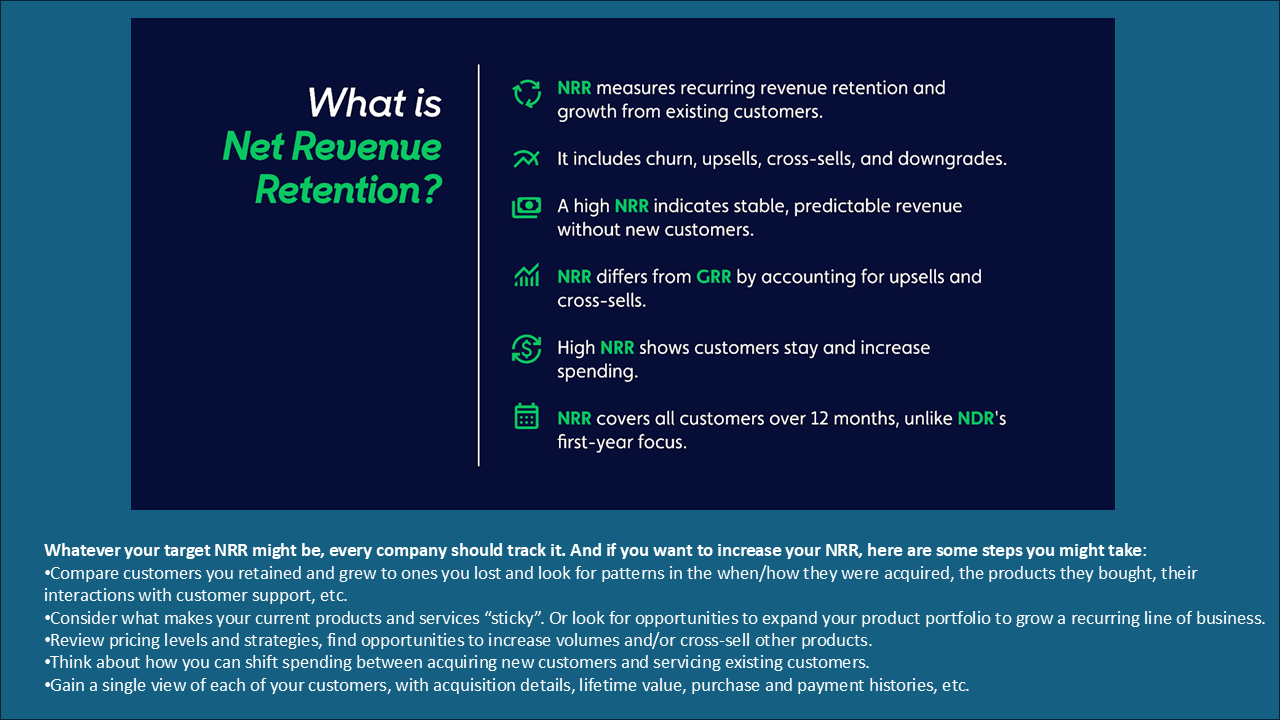

However, many companies, especially those with high-value accounts, prefer to measure retention by revenue retention, which accounts for the monetary value of retained clients rather than just the count. This includes metrics like Gross Revenue Retention (GRR) and Net Revenue Retention (NRR).

GRR excludes upsells and expansions, focusing purely on how much revenue is preserved from existing clients. NRR includes upsells and cross-sells, showing how much existing client revenue has grown or shrunk. For example, if a company starts with $100 in recurring revenue and loses a $10 client but gains $5 in upsells from others, the NRR would be 95%. This method is beneficial in SaaS and B2B industries where client value varies widely.

Some companies also use In-Year Revenue (IYR) to measure retention against projected annual revenue. For example, if a client was forecasted to contribute $10 in revenue this year but cancels early and only delivers $8, retention is recorded as 98%. While IYR helps understand short-term revenue impact, it falls short of capturing the long-term consequences of churn, such as lost lifetime value, recurring revenue, or future growth potential.

So what do I recommend? The best practice is to use both customer retention and revenue-based retention metrics in tandem. This dual approach helps businesses understand not only how many clients they’re keeping, but also how valuable those relationships are over time. Using these two measures helps identify operational issues, e.g., heavy client churn vs. key client (high revenue or high growth potential) churn.

To help guide further, the customer retention metric is obvious; however, GRR vs. NRR:

Use GRR for risk management and operational health: “Are we keeping what we have?” Tells you the underlying customer health, e.g., % of revenue at risk/lost.

Use NRR for growth strategy and investor conversations: “Is our existing base expanding over time?” This indicates the overall growth effect, for example, where losses are partly offset by expansion.

I understand, and I wouldn’t advise “over KPI” the business, but you’ll find using Customer Retention + either GRR or NRR helpful. Run various scenarios to understand the output better and determine what works for your business.

How to Boost Client Retention: Tips and Strategies

So, how can you keep clients sticking around for the long haul? Here are some tried-and-true strategies to improve client retention:

Deliver Stellar Customer Service: This one’s a no-brainer, yet it’s where many companies slip. Excellent service is the foundation of retention. If customers know they’ll be taken care of, they have little reason to leave. On the flip side, one bad experience can send them running. Remember that up to 72% of customers will switch brands after a single poor service incident. Don’t let that be your story. Invest in training your support and account teams to be responsive, helpful, and empathetic. Encourage a company culture that genuinely puts the customer first. We all have worked for companies with this mantra, but is it real or just lip service? When mistakes happen, and they will, address them quickly and make it right. As the saying goes, under-promise and over-deliver to exceed your client’s expectations when you can.

Personalize the Client Experience: Nobody likes to feel like just another number. Using data and customer insights to personalize interactions can significantly boost loyalty. Whether it’s tailoring your communications, customizing product/service offerings, or simply remembering a client’s preferences, personalization shows clients you value them as individuals. About 80% of customers are more likely to do business with you if you offer personalized experiences. This could mean sending targeted content that’s relevant to their needs, offering tailored solutions, or even small touches like congratulating them on their milestones. Modern CRM tools make this easier at scale. When clients feel understood rather than sold to, they stick around.

Implement Loyalty Programs or Perks: One proven way to boost retention, especially in B2C, but B2B can use this too, is to reward loyalty. Consider the coffee shop punch card, airline frequent flyer miles, or tech firms that offer premium support to long-term clients. These programs make customers feel appreciated and give them incentives to continue the relationship. The result is often a higher customer lifetime value and more repeat business. Get creative with perks that make sense for your business, such as discounts on renewals, exclusive access to new features, reward points, or invite-only events for loyal customers. Even a simple “loyalty discount” or declaring they are a “platinum client” at contract renewal can signal you value the ongoing partnership. It’s about saying thank you in a tangible way.

Listen and Act on Feedback: Customers want to be heard. Providing channels for feedback surveys, feedback forms, regular check-in calls, and then acting on that input can dramatically improve retention. Why? It identifies issues before they fester into reasons to leave, and it makes customers feel involved. Crucially, if a customer voices a concern and you fix it, they often become more loyal than if no issue had occurred in the first place. There’s data to back this up: 82% of customers are more likely to trust a company that asks for and acts on feedback. So create a tight feedback loop, for example, a monthly or quarterly business review with clients to ask “How can we do better?” and share what improvements you’ve made based on past input. Also consider tracking metrics like Net Promoter Score (NPS) or satisfaction ratings to quantitatively gauge retention risks.

Align Your Teams & Fulfill Your Promises: As highlighted, retention isn’t just the customer service team’s job; it starts with honest sales and is sustained by solid operations. Ensure your sales, product, and operations teams are aligned so that what is sold can be delivered at a quality level that meets or exceeds expectations. Nothing kills retention faster than overpromising and underdelivering. Sales teams avoid the temptation to promise the moon just to win a client; instead, set realistic expectations and then wow them in the execution. Internally, foster communication between the teams that land the client and those that onboard/serve the client. Handoffs should be smooth, and everyone should be on the same page about the client’s needs and goals. When sales and operations work hand-in-hand, clients experience a seamless journey.

Measure and Monitor Retention Metrics: You can’t improve what you don’t measure, as the old management adage goes. Make sure you’re tracking key retention metrics as discussed previously, such as churn rate (the percentage of customers or revenue lost in a period), retention rate, repeat purchase rate, and customer lifetime value (CLV). Keeping an eye on these numbers will alert you to problems early. It’s surprising how many companies neglect this or fail to see the reality in the numbers. Set retention goals and make it a shared KPI across relevant teams. Celebrate improvements in retention just like you would a big new sale; it reinforces the mindset that keeping clients is a win.

Conclusion

Client retention might not sound as thrilling as landing a huge new account, but it is where long-term success is often decided. High retention means a strong, stable, profitable revenue base, lower marketing costs, and a cadre of happy customers singing your praises. Poor retention, conversely, can stunt your growth and give your brand and growth aspirations a black eye. The good news is that improving retention isn’t a mystery; it comes down to consistently delivering value and care to your customers. As we’ve discussed, that involves everything from excellent service and personalization to internal alignment and listening to feedback.

Business leaders should treat client retention as mission-critical. After all, you worked hard to earn your clients’ trust and business; putting in the effort to keep that trust is far easier and more profitable than finding new clients to replace the ones you lost. In the end, a focus on retention creates a win-win: customers feel valued and stick around, and you get to build a thriving business with loyal advocates. And as a bonus, your sales team won’t have to watch their victories walk out the door.

Sources

Insights and data in this newsletter are drawn from publications and research, including:

Will Tidey, “Acquisition vs Retention: The Importance of Customer Lifetime Value,” Hüify Blog, June 25, 2024.

Industry Select, “41 Eye-Opening B2B Customer Retention Statistics,” Oct 16, 2024.

Taylor Landis, “Customer Retention Marketing vs. Customer Acquisition Marketing,” Outbound Engine Blog, Apr 12, 2022.

Ian Luck, “5 Innovative Customer Retention Examples and Case Studies,” Customer Gauge Blog, May 31, 2023.

Mariano Rodríguez, “How Amazon Maintains over 90% Customer Retention,” Beamer Blog, Oct 15, 2020.

Small Business Trends Staff, “Strategies to Increase Customer Retention for Long-Term Business Success,” Small Business Trends, Jul 2, 2025.

World Economic Forum – “Hiring with AI doesn’t have to be so inhumane” (Mar 2025)

University of Washington – Research on AI resume screening bias (Oct 2024)

Great article. In many businesses, there is not an endless pool of new clients/customers to pursue, so loosing a customer and getting a bad reputation significantly impacts the remaining pool you may be targeting.