The Emerging U.S. Air Taxi Industry

A New Era of Mobility Is Cleared for Takeoff

Introduction

As a kid, I vividly remember watching the cartoon show “The Jetsons” and dreaming about having my own aerocar with a transparent bubble top. Then came “Star Wars,” introducing the Cloud Car, and I was completely sold on the idea. Fast forward to the other day when I was driving on the highway with a passenger. I remarked, “Can you imagine if all these ‘challenged drivers’ were flying around? No way that will EVER happen!”

The notion of flying cars isn’t new; it’s been a part of our imagination for over a century, with the first hypotheses emerging in 1901. In the 1960s, it was predicted that by 2000, we would all be soaring in the skies. Many futurists in the early 2000s believed we’d see widespread flying car use by the 2020s. Yet, here we are, firmly rooted on the ground.

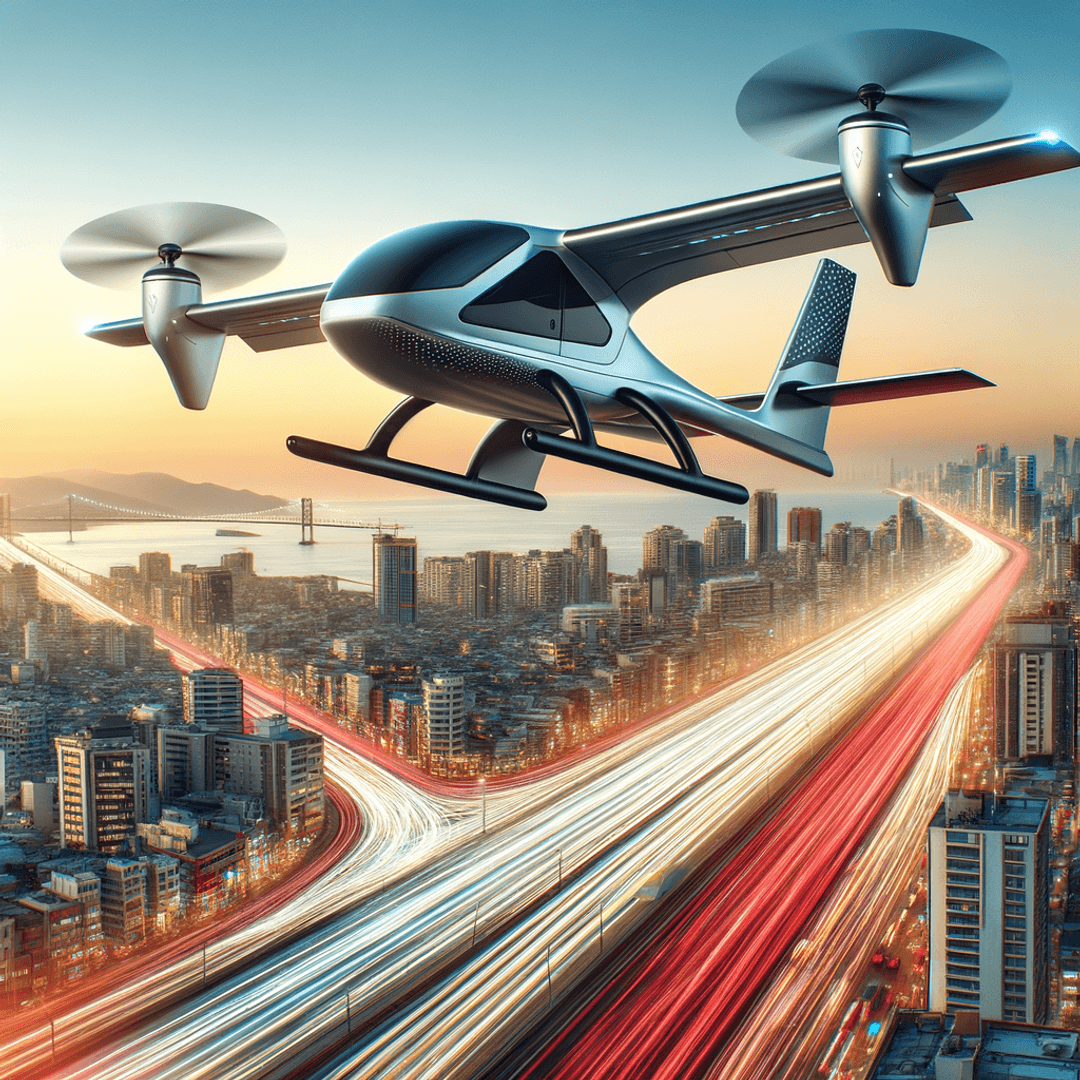

However, the concept of Urban Air Mobility (UAM), once a futuristic idea of “flying taxis,” is becoming a reality. Companies are developing small electric vertical takeoff and landing aircraft (eVTOLs) designed to transport a handful of passengers on demand at low altitudes, bypassing the traffic jams below.

With advancements in technology, including the use of lightweight materials, improved batteries, and automation, coupled with the growing challenges of urban congestion and lengthy commutes, this is a pivotal moment for the sector.

In just five years, over $14 billion has been invested in Advanced Air Mobility, primarily into eVTOL manufacturers, reflecting strong confidence that air taxis will soon be part of our transportation landscape.

Major U.S. airlines, automakers, and technology investors are backing startups in this space, while the FAA and NASA prepare for the integration of air taxis into national airspace. We’re on the brink of a mobility revolution in the skies, and a projected market worth hundreds of billions by 2040.

Investors and city leaders are closely monitoring developments, excited by the potential for faster travel within and between cities, new transportation networks, and a sustainable solution to urban gridlock.

So, why does it matter now? After years of prototypes and anticipation, the U.S. air taxi industry is nearing its first real deployments. Companies like Joby and Archer are conducting flight tests and working through FAA certification processes, aiming to transport passengers sometime in 2025 (primarily airport-to-downtown corridors).

The FAA’s recent “Innovate28” implementation plan targets initial scaled operations by 2028 in at least one U.S. city. Globally, developments are accelerating as well; for instance, China’s EHang received the world’s first certificate for an unmanned eVTOL. All these factors suggest that what was once merely a dream is now on the verge of reality.

For executives and investors, this emerging industry could unlock entirely new business models and ecosystem opportunities. For city planners and regulators, it necessitates immediate strategic thinking to ensure these new aircraft enhance urban mobility rather than disrupt it.

In short, urban air taxis represent more than just a new vehicle they signify a broader transformation in how we move people and goods, merging aviation with everyday urban transport.

What Air Taxis Are and The Problems They Solve

Air taxis are typically battery-electric VTOL aircraft designed to operate as on-demand air transportation within metropolitan areas. They carry a small number of passengers (often 2 to 6, plus a pilot), and can take off and land vertically, like a helicopter, enabling operation from compact “vertiports” atop buildings or parking lots, rather than full runways.

In essence, an air taxi is a highly automated, electric aircraft designed to ferry people or cargo at low altitudes (~3,200 feet or less) across town, addressing the need for faster travel in congested cities.

Key use cases for air taxis include:

Urban commutes and airport shuttles: One of the first targeted applications is connecting city centers to major airports or business hubs. For example, Archer Aviation (in partnership with United Airlines) is launching a route from downtown Chicago to O’Hare Airport, a trip that takes 45+ minutes by car, which could be flown in about 10 minutes.

Inter-city hops: Link nearby cities or suburbs (say 20–50 miles apart). This “air metro” concept could connect, for instance, New York City to the Hamptons or Los Angeles to Orange County, easing highway congestion for frequent routes.

Public services and emergency response: Beyond passenger convenience, air taxis could serve as a means for medical evacuations or organ transport within cities, provide fire-fighting support, or deliver emergency supplies in disaster-hit areas.

Tourism and aerial sightseeing: Air taxi services could offer scenic flights over metropolitan attractions or fast connections to tourist destinations (imagine hopping from Las Vegas to the Grand Canyon in minutes).

Logistics and cargo: Rapid delivery of high-value goods. Some designs can carry hundreds of pounds of cargo, offering potential solutions for last-mile delivery in congested cities or ferrying supplies to remote areas.

Air taxis aim to reduce time lost in traffic by utilizing vertical transport, potentially cutting travel times from hours to minutes. These quiet, zero-emission aircraft address noise and pollution concerns, and if costs decrease, they could become a viable alternative to driving in cities, similar to rideshare services, by avoiding road congestion.

Major Players and Partnerships: Who’s Leading the Charge

The U.S. air taxi landscape is taking shape around a few pioneering companies and their strategic partners. Below are the major players (including a few international leaders for context) and how they’re positioning themselves with partnerships in aviation and infrastructure:

Joby Aviation (U.S.): Widely considered a frontrunner, Joby is targeting a commercial launch in 2025 in American cities. It has secured substantial funding and partnerships: Toyota has invested heavily (over $400M) and is partnering on manufacturing, bringing automotive-scale expertise. Delta Air Lines took a stake in Joby to develop air taxi services shuttling its passengers to airports in New York and Los Angeles. Joby even acquired Uber’s Elevate division, aligning itself with rideshare networks. Its aircraft seats four passengers plus a pilot, boasts a range of ~150 miles, and is touted for its quiet profile. Joby’s strategy is vertically integrated, building the aircraft and operating the service with plans for ride-booking via app and Delta’s customer base feeding demand.

Archer Aviation (U.S.): Archer is another U.S. leader, also with a 4-passenger aircraft. Archer has a high-profile partnership with United Airlines, which not only invested in Archer but also placed a large order of up to 200 aircraft. Together, they announced the first planned U.S. air taxi route: Downtown Chicago (Vertiport) to O’Hare Airport in 2025. This “trunk route” model (connecting a city center to a major airport) is Archer’s beachhead strategy, after which secondary routes to suburbs would follow. Archer also partnered with automaker Stellantis (Fiat Chrysler’s parent), which is investing $55M and will help build Archer’s aircraft at scale. For infrastructure, Archer is working with local authorities in its target cities (Chicago, Los Angeles, and possibly Miami) to designate vertiports.

Volocopter (Germany): Leading in the EU with plans for global expansion, aiming for certification of its two-seat air taxi. The company has collaborated with infrastructure partners to build a prototype in Singapore. With a focus on safety and turn-key urban air mobility services, the company is seen as a benchmark

Lilium (Germany): Lilium is developing a unique 6-passenger aircraft that is designed for longer ranges (~150+ miles). The company’s approach is more akin to an air shuttle network connecting multiple cities or regional hubs. It has inked notable partnerships, such as with Lufthansa Airlines. Simultaneously, Lilium is working with Frankfurt Airport (Fraport) on integrating operations into a major airport’s infrastructure. Lilium had earlier announced plans for a Florida network (with Ferrovial to develop vertiports in cities like Orlando and Tampa. *Note: Atlantic Aviation acquired Ferrovial Vertiports in January 2025), backed by a deal with Brazilian airline Azul to deploy Lilium jets in Brazil. While Lilium’s timeline lags Joby/Archer, its vision of regional air mobility and high-profile partners position it as a long-term player if it can execute its technical roadmap.

Vertical Aerospace (UK): Developed a piloted model designed to seat four passengers. The company went public through a special purpose acquisition company (SPAC) and has secured approximately 1,400 pre-orders. Key partners include American Airlines, Virgin Atlantic, and Avolon. Vertical is collaborating with Rolls-Royce and Honeywell on the powertrain and avionics, and has also partnered with helicopter operators, such as Bristow, for future services. The first full-scale prototype took to the skies in 2022, with certification expected by 2026. Rather than operating as an airline, Vertical's focus is on selling aircraft, with plans to make a significant impact in the U.S. market through its alliance with American Airlines.

EHang (China): Notable for its flagship autonomous air taxi, which operates without a pilot. The company has conducted demonstration flights in China, including tourism flights in Guangzhou. The company envisions deploying fleets for various purposes, all of which will be managed from a central command center. Although EHang does not have major airline partners, it has collaborated with the Chinese government and is exploring partnerships in Asia, including the development of firefighting drones in Japan and a tourist operation in Bali.

Other notable mentions in the ecosystem include Wisk Aero (a Boeing-backed U.S. startup developing a self-flying air taxi, though its autonomous approach means a longer timeline into the 2030s) and Eve Air Mobility (spun out of Embraer, Brazil, with significant orders and partnerships, including with Blade and UPS). Major aerospace and transportation companies are also circling: Airbus is developing a prototype; Hyundai has a UAM division aiming for 2028 service; and ride-sharing firms like Uber (via Joby) and Lyft have shown interest in integrating air options.

Market Opportunity

The potential market opportunity for urban air mobility is enormous; however, estimates vary widely due to the early stage. Several reputable analyses agree on high long-term upside:

Morgan Stanley famously projected the global market could reach $1.5 trillion in annual revenue by 2040, and even $9 trillion by 2050. However, in the latest update, Morgan Stanley moderated its base-case outlook to about $1.0 trillion by 2040. *Note: Investors often cite these numbers to justify the hefty valuations of eVTOL startups.

McKinsey & Co. also sees transformational potential, though with scenario-based outcomes. In one McKinsey scenario, advanced air mobility could generate on the order of $300–400 billion in annual revenue by 2040 globally (assuming a “breakthrough” pace of adoption).

Other forecasts underscore uncertainty in timing. The variability in these forecasts highlights the dependency on technology, regulation, and consumer uptake that remains to be proven.

Revenue streams in a mature air taxi market would likely come from passenger fares (akin to airline or rideshare revenue), business travel services (corporate subscriptions or memberships for frequent flyers), logistics/cargo fees, and potentially public sector contracts (for emergency services).

The business models are still being defined. Some companies plan to operate their own fleets and generate revenue based on each trip, similar to the "Uber of the air" model. In contrast, others aim to sell aircraft to fleet operators or airlines, earning manufacturing margins while also generating revenue from support services.

Infrastructure needs present another facet of the market opportunity (and necessity). To unlock these revenue forecasts, significant investment in physical and digital infrastructure is required:

Vertiports are the equivalent of airports, featuring landing pads, passenger handling facilities, and charging stations. Cities will need networks of vertiports strategically placed for efficient routes (e.g., one in each major business district, at key transit hubs, and at airports). Real estate developers and infrastructure funds are already looking at parking garages, rooftops, and unused land as potential vertiport sites. As of 2025, dozens of vertiport projects are in the planning stage globally, but widespread construction will require clear revenue signals and regulatory approvals.

Energy and charging infrastructure: High-power charging systems or battery swap facilities will be needed at vertiports to quickly turn the electric aircraft. Utilities and city power planners will need to ensure capacity for clusters of electric air taxis, especially if dozens could charge simultaneously during peak hours.

Air Traffic Management (ATM) systems: To safely manage potentially hundreds of new low-altitude flights, new traffic management solutions are required. The existing air traffic control (ATC) system is not designed to handle high volumes of flights below 5,000 feet in urban areas. NASA and the FAA have been testing Unmanned Traffic Management (UTM) concepts and digital flight corridors for drones and eVTOLs.

Maintenance and support infrastructure: Like helicopters and airplanes, eVTOL fleets will need hangars, maintenance facilities, and repair services. This opens opportunities for MRO (maintenance, repair, overhaul) providers in the long term. Initially, manufacturers might handle their own fleet maintenance (Joby, for example, might maintain its airline-style operations in-house), but as the industry grows, third-party service networks could emerge.

All of these elements will require investment, creating adjacent markets for construction, technology, and services. In summary, the market opportunity for air taxis extends far beyond selling aircraft. It encompasses an entire ecosystem of manufacturing, services, and infrastructure that will evolve over the next two decades.

Barriers to Adoption

Air taxis offer big promise, but several serious roadblocks stand in the way of widespread adoption in the U.S.:

Regulatory Hurdles: FAA certification remains the single largest barrier to success. As of mid-2025, no eVTOL has received full type certification, and production and operator approvals are still pending. Safety concerns make regulators cautious, which slows progress.

Infrastructure & Airspace: Vertiports need to be built, airspace integrated, and zoning approvals secured, none of which are fast or easy. Early routes will be limited, which will reduce flexibility and profitability.

Noise & Public Acceptance: Despite quiet designs, community pushback is likely to occur. Cities like New York City already resist helicopter traffic. Public trust will hinge on noise reduction, transparency in flight paths, and effective community outreach.

Safety Perception: People are wary of flying in new, small aircraft, especially those that are autonomous. One incident could derail trust. The industry must prove airline-level safety through redundancy, testing, and human-piloted rollouts.

Battery Limits: Current batteries have a range of ~20–50 miles per trip. Performance, lifespan, and thermal risks are still issues. Until next-gen batteries arrive, scale and economics remain constrained.

Business Viability: High initial costs mean early rides will be pricey, limiting adoption. The challenge: scale manufacturing, reduce costs, and expand into broader markets. Without enough infrastructure or riders, the “chicken-and-egg” problem persists.

Bottom line: These challenges aren’t insurmountable, but they will take time, trust, tech breakthroughs, and billions in capital. The winners will be those who navigate the gauntlet best, striking a balance between innovation, safety, and brilliant execution.

When Will Air Taxis Become a Reality?

2025–2026:

Initial commercial flights begin. Joby and Archer aim to launch limited routes (e.g., Chicago to O’Hare, New York City to JFK) pending FAA certification. Operations will be small-scale, piloted, and use existing infrastructure, similar to helicopter shuttles.

2027–2028:

More cities join early trials. The FAA’s Innovate28 initiative aims to target “at-scale” urban operations in at least one city by the 2028 LA Olympics. Expect expanded fleets, more visibility, and closer regulatory alignment.

2029–2030:

Transition from trials to networks. Expect broader service in major hubs such as Los Angeles, Miami, and Dallas. Routes increase, but flights are still piloted and follow fixed corridors under visual flight rules.

2030–2035:

Scaling begins. Manufacturers ramp up production, and more cities deploy services. Autonomous cargo flights may start. Regulatory frameworks loosen, and early consolidation in the industry begins to emerge.

2035–2040:

Potential tipping point. Autonomous passenger flights emerge in some regions. Networks of vertiports link metro areas. Air taxis are becoming a viable mode of urban transportation, particularly for accessing airports and premium routes.

Preparing for the Air Taxi Era

Investors:

Think long-term. The air taxi market will take time to mature, with real revenues unlikely before 2030. Focus on companies with substantial capital, partnerships, and progress in certification. Diversifying across the ecosystem, including battery technology, vertiport infrastructure, autonomy software, and suppliers, may offer lower-risk, high-upside plays. Be patient and policy-aware.

City Planners:

Start preparing now. Identify vertiport sites, update zoning and building codes, and engage with the local community. Build cross-agency task forces to coordinate efforts. View air taxis as part of a multimodal network and consider public-private partnerships. Early movers can become industry hubs, but equity and access must be part of the plan.

Operators & Mobility Providers:

Air taxis will complement or disrupt existing services. Airlines should integrate Urban Air Mobility into their hubs and loyalty programs to enhance their offerings. Helicopter operators can transition to eVTOL. Rideshare and logistics companies should prep for “third-dimension” integration. Train pilots, ready IT systems, and partner early to stay competitive.

Adjacent Opportunities:

Infrastructure, real estate, software, insurance, finance, and workforce development all stand to benefit. “Picks and shovels” businesses that enable UAM rather than flying it may offer faster, more stable returns with lower regulatory hurdles.

Competitive Positioning:

Air taxis should be marketed as solutions to specific pain points, such as airport commutes and congested routes, rather than as luxury toys. Sustainability, speed, and reliability will be key differentiators. Partnering with trusted brands can help gain public trust.

Final Word:

UAM isn’t science fiction; it’s a coming shift in mobility. Early engagement and strategic positioning across sectors will determine who leads when the skies open for business.

Conclusion: Air Taxis and the Future of Mobility

Air taxis represent more than a novel mode of transport. They signal a shift toward a brighter, more integrated future of mobility. Like the car and the jet before them, eVTOLs have the potential to reshape how we live, work, and navigate cities. While the path forward involves regulatory, technological, and societal hurdles, the direction is clear: mobility is moving into the vertical dimension.

This isn’t about luxury rides for the elite. Air taxis could unlock real efficiency in crowded urban areas, acting as airborne connectors in a multimodal network that includes autonomous shuttles, trains, and intelligent routing platforms. Rooftops may evolve into vertiports. Drones may handle urgent deliveries. The urban sky could become a carefully managed, high-value traffic layer.

For leaders and investors, this is not just about flying vehicles. It is about entering a new mobility ecosystem built on electrification, automation, and data. The opportunity lies in solving longstanding problems of congestion, access, and emissions by using new tools. Cities that embrace this shift early could gain a significant edge in economic growth and talent attraction.

Ultimately, air taxis are no longer science fiction. They are part of a broader, transformative wave in the transportation industry. The sky is not the limit anymore; it is the next highway. Now is the time to shape how we use it.

Sources

Insights and data in this newsletter are drawn from publications and research, including:

FAA’s Innovate28

Joby/Archer press releases

Morgan Stanley & McKinsey forecasts

Noise/performance tests

Airspace management and vertiport development plans