Tesla: How a Car Company Transformed into a Tech Empire (and What We Can Learn from It)

(5 Min Read)

Before we dive deep into the world of AI, which I promised you last week, I want to take a timely detour. With Tesla dominating the headlines recently, it seemed fitting to bring you a story that is not just about cars, but also deeply rooted in AI, energy, robotics, and business strategy. Few companies have blended artificial intelligence into their core business as boldly as Tesla has. In fact, you could argue Tesla is quietly becoming one of the most important AI companies on the planet — all while selling millions of cars and building the grid of the future.

In this edition, I’ll explore how Tesla became a multi-industry disruptor, what business owners and investors can learn from its playbook, and how AI isn’t just a side project for them — it’s central to their story. You may think you know everything about the company, but trust me, you don’t, and you will learn something in this edition.

The Origin Story: Speed Bumps, Scrappy Beginnings & A World-Changing Mission

Tesla wasn’t born out of Silicon Valley hype or a billionaire’s side project. It began, fittingly, in a small office in Menlo Park, California, when engineers Martin Eberhard and Marc Tarpenning co-founded the company in 2003. Their mission? Simple, yet bold: “to accelerate the world’s transition to sustainable energy.” Their early thesis was that electric vehicles (EVs) could outperform gas cars — not just in emissions, but in performance, design, and desirability. The problem? No one believed them. The world still viewed EVs as glorified golf carts (I know I did).

When Elon Musk joined the scene, initially as an investor, things began to change. Musk led Tesla's first significant funding round in 2004 and quickly became its most visible leader. He wasn’t just supplying capital — he was supplying vision. Musk pushed Tesla to think beyond niche EVs and aim for something more radical: make EVs so good that customers would want them not because they were eco-friendly, but because they were simply better cars.

Tesla’s first vehicle, the Roadster (2008), was a technical marvel—a sleek electric sports car that could accelerate from 0 to 60 mph in under 4 seconds, powered by lithium-ion batteries. It changed perceptions overnight. Suddenly, EVs weren’t slow or boring. But what the public didn’t see was the chaos behind the scenes.

Tesla faced immense manufacturing challenges. Building the Roadster was more of an engineering science project than a scalable product. Supply chain problems, battery safety issues, and financial shortfalls plagued the team. Then came the 2008 financial crisis, which nearly sealed Tesla’s fate. Musk personally led a desperate, last-minute funding round — even wiring his last personal cash reserves into Tesla — just to meet payroll. Tesla survived by inches.

But the real game-changer wasn’t the Roadster. It was the master plan Musk quietly laid out in a blog post at the time:

Build a high-end sports car (the Roadster)

Use that money to build a more affordable luxury sedan (the Model S)

Then use those proceeds to fund a mass-market vehicle (the Model 3)

This strategy was clear, methodical, and far more ambitious than most realized.

In 2012, the Model S launched to rave reviews. It wasn’t just good “for an EV” — it was good, period. It won MotorTrend Car of the Year, outpaced Porsches, and featured a touch-screen interface years ahead of its competitors.

Yet, scaling remained Tesla’s Achilles’ heel. By the time the Model 3 was set to launch, Tesla faced another existential crisis. Between 2017 and 2019, the company experienced what Musk infamously referred to as “production hell.” Factories were bottlenecked, automation glitches piled up, and Wall Street predicted Tesla’s collapse.

Musk later admitted that Tesla was within weeks of bankruptcy during this period. He was working 120-hour weeks, sleeping on factory floors, and personally troubleshooting robotic arms. Somehow, they powered through, emerging stronger.

By 2020, Tesla wasn’t just surviving — it was thriving. The Model 3 became the world’s best-selling electric vehicle, and Tesla became the most valuable automaker on the Planet.

Automotive: Reinventing the Wheel (and Everything Else)

Tesla’s automotive division is the core of its empire. Today’s product line includes:

Model S – Luxury sedan

Model 3 – Mid-range sedan

Model X – Luxury SUV

Model Y – Mass-market crossover (the best-selling car in the world in 2023)

Cybertruck – A polarizing, angular pickup truck with stainless steel exoskeleton

Tesla Semi – A long-haul electric freight truck

Next-gen Roadster – An ultra-high-performance sports car

Tesla’s genius, however, goes beyond sleek designs. They’ve revolutionized manufacturing by introducing Gigafactories, giant casting machines (Gigapress) that reduce part counts, and vertically integrating everything from batteries (including their own 4680 cells) to software. Their direct-to-consumer model eliminates the need for traditional franchised dealerships (Tesla has 276 locations across the US), allowing them to control pricing, customer experience, and margins.

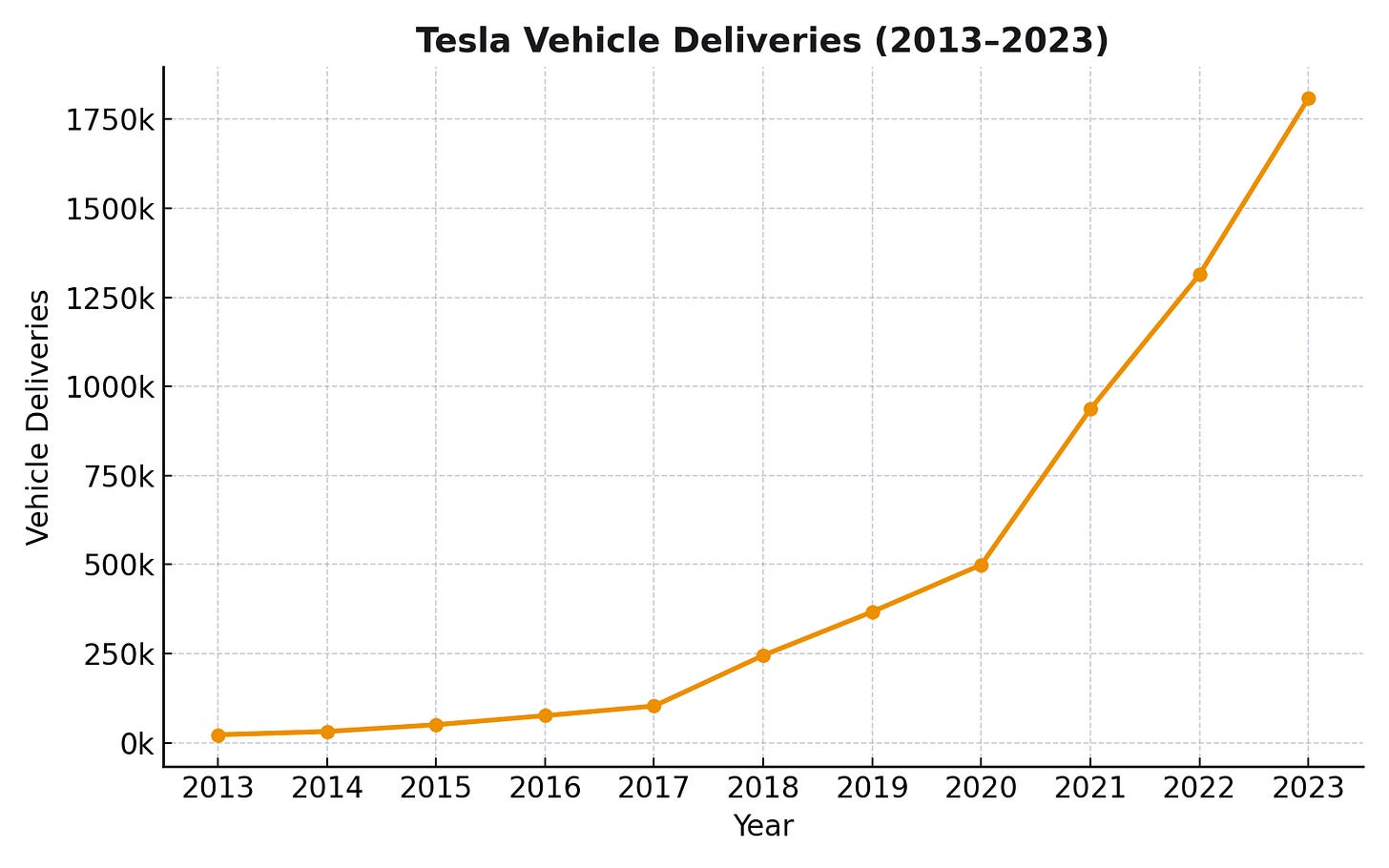

Tesla's scale is staggering: from delivering ~22,000 vehicles in 2013 to nearly 1.8 million in 2023 (this number decreased in 2024 to 1.79 million, and current projections for 2025 indicate a 13% decrease). The Model Y alone outsold every other vehicle globally in 2023.

Lesson? Innovation isn't just about products — it's also about processes.

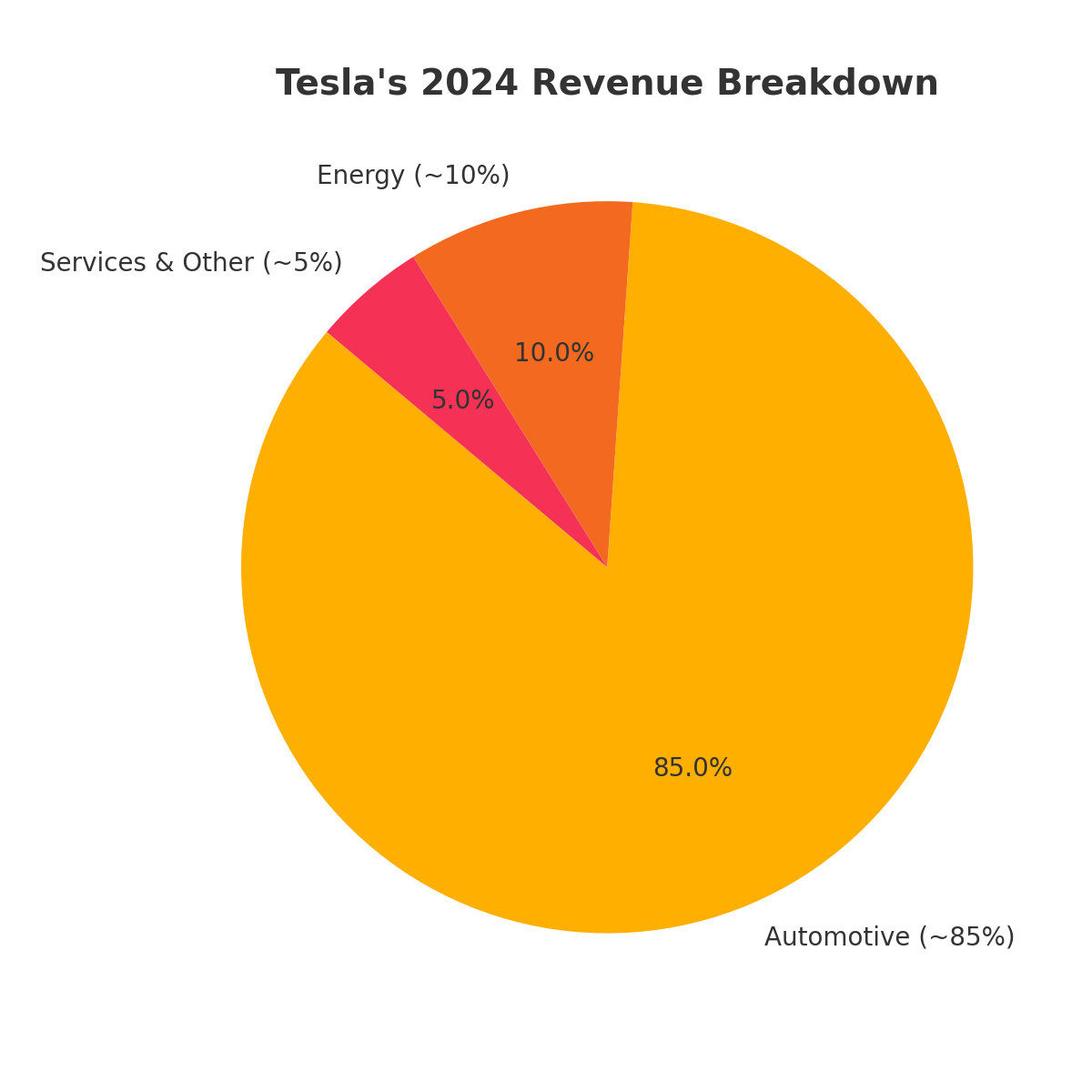

Energy: The Unsung Hero of Tesla’s Business

Most people still think of Tesla as just a car company, but its energy division is quietly booming. After acquiring SolarCity in 2016, Tesla launched:

Powerwall – Residential battery storage

Megapack – Utility-scale battery storage

Solar Panels & Solar Roof – Solar generation products

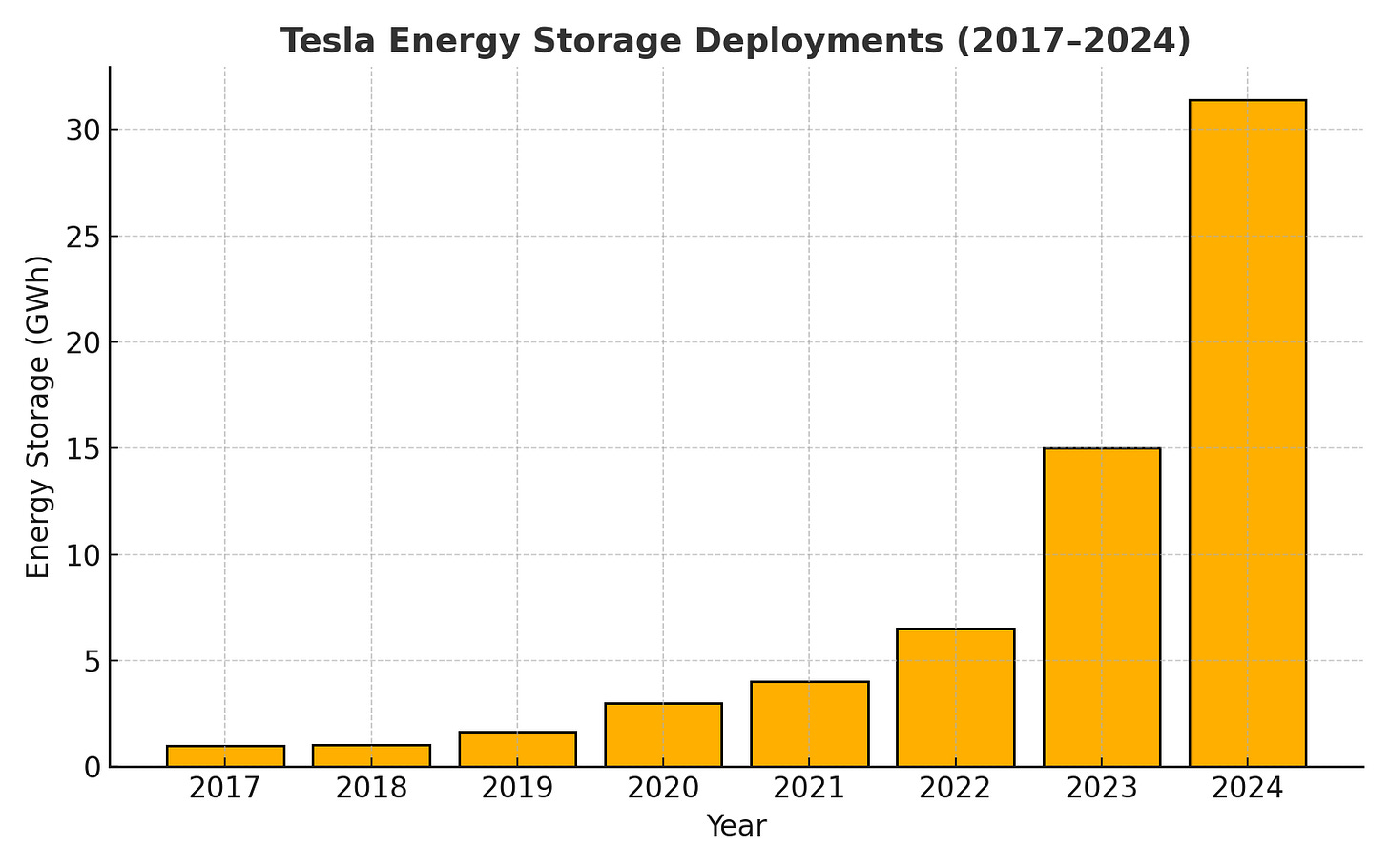

In 2024, energy storage deployments more than doubled to 31.4 GWh, and energy revenue surged past $10 billion, growing 67% YoY with 20–25% gross margins — rivaling industrial peers.

Why does this matter? The global demand for grid-scale storage is expected to surpass 1,000 GWh/year by 2030. Tesla, leveraging its battery expertise and vertical integration, is well-positioned to capture a significant market share. With the new Shanghai Megapack factory ramping up last month, Tesla is positioning itself globally, especially in the Asia-Pacific market.

Beyond hardware, the company is developing energy software, including virtual power plants and grid-balancing services, which have the potential for recurring revenue upside, thereby creating synergies between its automotive, AI, and energy capabilities.

The brilliance? In short, Tesla is applying its core strengths to dominate a second high-growth market.

AI and Autonomy: Tesla the AI Company

Tesla’s most ambitious play isn’t just in cars — it’s in autonomy. Through Autopilot and Full Self-Driving (FSD), Tesla is working to develop fully autonomous vehicles, powered by billions of miles of real-world driving data. What makes them unique? Tesla is betting entirely on vision-based AI, using cameras and neural networks instead of light detection and ranging (LIDAR) — a decision that is both controversial and defining.

At the core of this effort is the Dojo Supercomputer, Tesla’s custom-built AI training machine designed to process exabyte-scale video data. Analysts, including Morgan Stanley, believe Dojo could add up to $500 billion in value if it enables Tesla to scale an autonomous robotaxi network.

FSD today is still in beta and requires driver supervision, but Tesla claims steady improvements. More importantly, Tesla’s AI isn’t limited to vehicles. It’s also being applied to Optimus (their humanoid robot) and energy grid optimization, hinting that Tesla may evolve into a true AI platform company — not just an automaker.

Lesson? Owning your data and having the tools to process it is a valuable advantage that many businesses underestimate.

Robotics: The Optimus Experiment

As if cars and AI weren’t enough, enter Optimus — Tesla’s humanoid robot, standing at 5'8”, 125 pounds.

Unveiled in 2022, Optimus is designed to handle tasks that are boring, repetitive, or hazardous. Musk envisions Optimus eventually replacing human labor for many tasks — from factory work to elder care.

Although still a prototype, Tesla claims that Optimus could enter production by 2026 and is already capable of performing simple tasks, such as moving objects autonomously. What is the revenue potential?

Low-range scenario: $5–15 billion in revenue by 2030 if Tesla deploys thousands of units internally and sells early-stage commercial models.

High-range scenario: $50–100 billion in annual revenue by 2035, if Optimus successfully scales to external industries such as logistics and healthcare.

Wild? Absolutely.

Impossible? History says you might want to think twice before doubting.

Financials: Growth, Profits, and Pressure

Tesla’s financial trajectory is nothing short of historic. In 2012, the company generated $413 million in revenue. Fast forward to 2024, and that number has ballooned to nearly $98 billion. What may not be common knowledge is that the company posted its first annual profit in 2020.

Yet, 2025 will be a reset year. Faced with intensifying competition from both legacy automakers and emerging EV players, Tesla slashed prices across its lineup to maintain demand — a move that protected volume but compressed margins. Net income dropped by roughly 52% year-over-year, and Tesla's once best-in-class profitability now resembles that of more traditional automakers.

But make no mistake — Tesla is not struggling, it's adapting. The company still boasts a fortress-like balance sheet, deep vertical integration, and a diversified portfolio well beyond cars. With growing businesses in energy, AI, and robotics, Tesla has multiple levers to pull, positioning it to navigate short-term turbulence while remaining a key force shaping the future of multiple industries.

The Next 5 Years: What’s Next?

While Elon Musk once touted a 20 million vehicle/year goal by 2030, most analysts now project something closer to 4–5 million by then. Given recent developments, I expect this number to be closer to 3 million, but that is a guesstimate.

Ark Invest, a company that focuses on Disruptive Innovation, remains highly bullish, forecasting that Tesla’s annual revenue could exceed $760 billion by 2029 — primarily driven by autonomy and AI. More conservative estimates place Tesla’s 2030 revenue closer to $200–300 billion.

Even if Tesla misses the most optimistic projections, it’s clear the company is well-positioned to remain a dominant player across automotive, energy, and AI.

Business Lessons from Tesla

Here’s what Tesla teaches us, beyond the headlines:

Big Vision Attracts Big Capital – Tesla didn't just sell cars; it sold the future.

Vertical Integration = Control & Margins – Tesla controls everything from chips to charging stations.

Storytelling is Strategy – Musk's narrative generates billions in free marketing.

Survive the Hard Times – Near-bankruptcy didn’t kill Tesla; it made them stronger.

Leverage Data – Tesla’s data flywheel powers its competitive advantages.

Synergize Growth – Energy storage, AI, and robotics aren’t distractions — they are extensions of the core mission.

Tesla’s playbook is less about copying individual moves and more about adopting the mindset of integrated innovation and calculated risk-taking.

Conclusion: Betting on the Bold

Tesla’s story is still unfolding, but it has already redefined industries, investor expectations, and what’s possible when vision meets execution. Whether you’re leading a $20 million or $20 billion business, the takeaway is the same: think bigger, integrate deeper, and never underestimate the power of persistence.

Sources

Tesla 2024 Q4 Shareholder Deck

Tesla 2024 Earnings Call Transcript

Morgan Stanley: “Dojo Report: $500B of Optionality?”

ARK Invest Big Ideas 2024 Report

Reuters, Bloomberg, WSJ, Electrek (2023–2024 coverage)

Tesla AI Day Presentations (2022, 2023)

Statista EV Delivery Data (2023)