Starlink: A Strategic Briefing

What Leaders Need to Know About SpaceX's Satellite Power Play

Introduction

In less than a decade, SpaceX’s Starlink has evolved from an ambitious concept into the world’s largest satellite internet network, reshaping global connectivity, redefining telecom competition, and emerging as a tool of geopolitical significance.

This strategic briefing offers a comprehensive overview of Starlink’s development, current capabilities, use cases, financial trajectory, and competitive landscape.

It also examines Starlink’s broader implications for business leaders, investors, and policymakers as the convergence of space, technology, and infrastructure enters a new era.

The reason I wanted to discuss Starlink is that I am an avid backpacker who enjoys exploring high-elevation, remote areas. One of the main attractions of this activity is the lack of connectivity. I don’t want to be connected.

However, for safety purposes, I do use a SPOT Satellite GPS Messenger (Gen 4), which relies on the Globalstar satellite network to transmit data from anywhere in the world. It’s $25 a month, and the device is $150.

I have been considering switching to Starlink because having a reliable way to signal for help is crucial. I will likely make the transition at some point as costs decrease, and I am very curious about how this technology will impact businesses and our overall way of life. Let’s explore that!

History and Key Milestones

2015 – Project Announcement: SpaceX CEO Elon Musk announced plans for a satellite internet constellation (later named Starlink) in January 2015, followed by the opening of a satellite R&D facility in Redmond, WA. Musk estimated a ~$10 billion investment and positioned Starlink’s profits as funding for SpaceX’s Mars ambitions. Yes…Starlink falls under SpaceX.

2018 – Test Satellites: SpaceX launched two demo satellites in February 2018 to validate the technology. That year, the U.S. FCC granted approval for an initial 4,425-satellite network, contingent on deploying at least half by 2024.

2019 – First Launches: In May 2019, SpaceX deployed the first batch of 60 operational Starlink satellites into low Earth orbit (LEO) on a Falcon 9 rocket. By November 2019, Starlink launches were occurring regularly (with ~60 satellites per launch) to build out what is called “the constellation”.

2020 – Beta Service: Starlink began a private beta in mid-2020 and opened a public “Better Than Nothing” beta by October 2020. Early beta users reported download speeds of over 150 Mbps (sufficient for gaming, etc.), demonstrating broadband-class performance.

2021 – Initial Commercial Service: In 2021, Starlink began accepting general pre-orders and rolling out service in the U.S., Canada, and the UK, with a focus on rural and underserved regions. SpaceX also secured licenses in various countries and began scaling production of user terminals.

2022 – Growing Network and War Role: By 2022, Starlink’s constellation surpassed 2,000 satellites and expanded service to all seven continents. The user base grew to over 1 million by year-end. Notably, Starlink was rapidly deployed to Ukraine after Russia’s invasion to restore communication, becoming a lifeline for the Ukrainian military and civilians (initially funded by SpaceX, later by the U.S. and allies).

2023 – Rapid Expansion: SpaceX continued to launch near weekly, scaling the network to ~3,500+ satellites by early 2023. Starlink surpassed 1.5 million customers by the end of Q2, and SpaceX reported that Starlink hardware was no longer sold at a loss as economies of scale took effect. In mid-2023, the U.S. Department of Defense signed contracts to formally fund Starlink services for Ukraine. SpaceX also introduced a military-focused Starlink variant called Starshield for secure government communications.

2024 – Scale & Profitability: By May 2024, Starlink’s constellation reached around 4,000 active satellites and approximately 3 million subscribers worldwide. SpaceX disclosed Starlink had generated $1.4 billion in 2022 (up from $222 million in 2021) and turned a quarterly profit in 2023. Starlink’s service became available in ~100 countries and territories as regulatory approvals expanded.

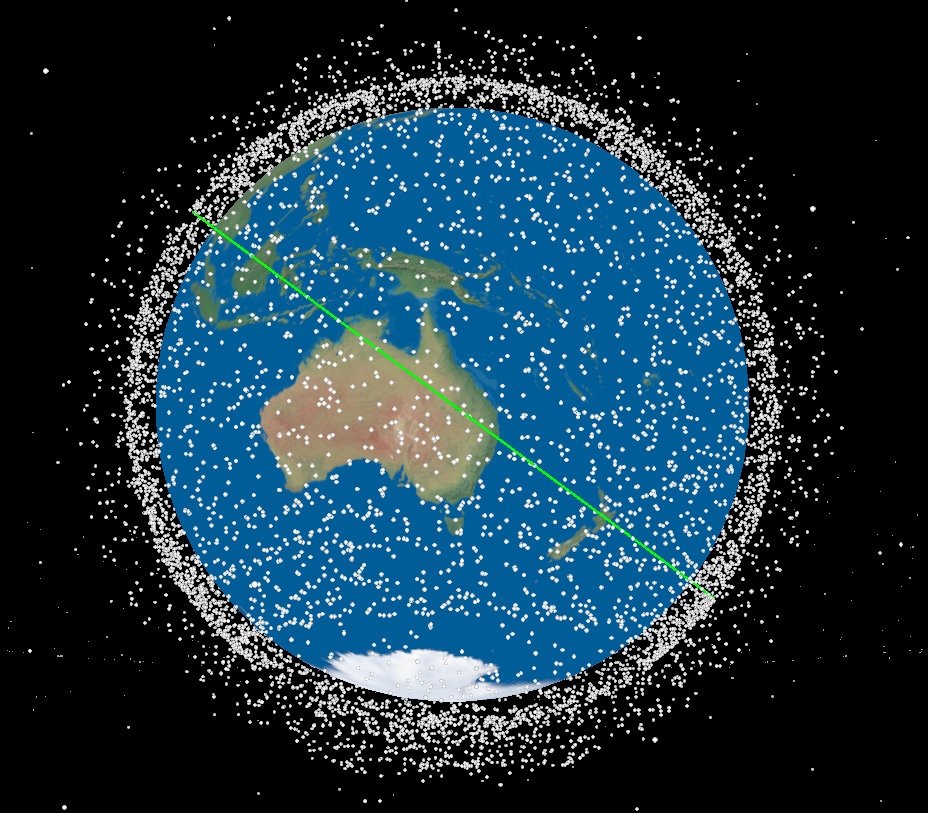

2025 – Largest Satellite Network: Starlink is now by far the world’s largest satellite network. As of March 2025, SpaceX had over 7,100 Starlink satellites in orbit (roughly two-thirds of all active satellites in existence). The constellation is on track to achieve global mobile coverage, and SpaceX projects that Starlink’s annual revenue could reach approximately $12 billion in 2025. SpaceX’s valuation has climbed to ~$350 billion, with Starlink estimated to comprise about 60–65% of that value (over $200 billion). Musk has floated the idea of spinning off Starlink, but most recently stated that there is no near-term plan for an initial public offering (IPO).

Current Deployment and Technology Model

Starlink operates a mega-constellation of low-Earth orbit (LEO) satellites designed to deliver broadband internet globally. Unlike traditional geostationary satellites at 36,000 km, Starlink satellites orbit at an altitude of ~550 km, dramatically reducing latency to 20–40 ms (similar to ground fiber) and enabling responsive two-way connectivity.

SpaceX mass-produces these small satellites and launches them in batches of 20–60 on Falcon 9 rockets. As of early 2025, over 7,100 Starlink satellites are in orbit, with ~7,100 functioning (some deorbited as newer models replace them).

This massive deployment provides Starlink with unrivaled coverage. It is the only high-bandwidth satellite network with near-global reach, spanning North America, Europe, Asia, Africa, Oceania, and even the polar regions.

Each Starlink satellite is equipped with phased-array antennas and lasers. The user connects via a pizza-box-sized dish antenna on the ground, which communicates with the overhead satellites. Newer satellite versions include laser inter-satellite links that allow Starlinks to relay data to one another in space.

This means a Starlink satellite passing over, say, a ship in the ocean can beam internet to another Starlink satellite in range of a distant ground station, without the need for local infrastructure. The network dynamically hands off coverage between satellites as they move, and sophisticated software in user terminals allows seamless connectivity as multiple satellites rise and set overhead.

SpaceX also operates a global ground station network and secure gateways, including partnerships with major data centers (e.g., Google and Microsoft) to route Starlink traffic into the internet backbone for efficient content delivery.

Coverage and capacity: With thousands of satellites, Starlink can provide service virtually anywhere on Earth. Initially, coverage focused on higher latitudes, but now spans equatorial regions as well.

The network’s capacity is shared among users in a cell, so speeds can vary. Individual users typically experience download speeds of 50–200 Mbps (sometimes higher in low-congestion areas) and upload speeds of 10–40 Mbps. In layman’s terms, these speeds are excellent. Starlink’s low latency enables applications such as video calls, VPNs, and online gaming, which were previously impractical on traditional satellite links.

To manage demand, SpaceX has implemented various service tiers and data policies (such as data caps or “Priority” data buckets on some plans) to ensure the growing customer base can be supported. Ongoing launches continually add capacity, and SpaceX plans to use its Starship rocket in the near future to deploy second-generation Starlink satellites that are larger and even more capable.

These upgrades aim to increase bandwidth per satellite and eventually enable direct connectivity to standard smartphones (a future service announced in partnership with T-Mobile for text messaging). In summary, Starlink’s technology model leverages low-orbit, high-volume deployment and novel communications technology to deliver broadband.

Use Cases and Customer Base

Starlink’s customer base spans consumer, commercial, and governmental users, addressing scenarios where traditional connectivity is unavailable or inadequate:

Rural and Underserved Consumers: The primary market for Starlink has been individual households and businesses in rural or remote areas that lack high-speed internet. Starlink enables these users, ranging from farms in Iowa to villages in the Amazon, to access broadband without the need to wait for fiber or cable lines.

Enterprises and Industry: Starlink offers business-grade plans for enterprises in remote areas, including mining, energy, construction, and agribusiness. Partnerships with cloud service providers, like Microsoft’s Azure Space, enhance client connectivity by combining satellite internet with cloud computing. Many small and medium businesses, from resorts to oil rigs, are adopting Starlink to access reliable broadband.

Maritime Internet: Starlink is being adopted across the maritime sector, from shipping to leisure. SpaceX launched Starlink Maritime plans in 2022, initially at a high price (~$5,000/month for unlimited use), targeting commercial ships, superyachts, and offshore rigs. In 2023–24, they introduced more affordable maritime plans (starting at $250/month with data caps) to serve fishing vessels and private boat owners. Almost all of the major cruise lines have a partnership with Starlink to provide internet services on board their ships.

Aviation and Mobility: In-flight internet is being revolutionized by Starlink. SpaceX developed Starlink Aviation terminals that can be mounted on aircraft, offering up to 350 Mbps to each plane. Several airlines have signed on, notably Hawaiian Airlines, which has begun offering free Starlink Wi-Fi on its trans-Pacific flights (becoming the first major carrier to do so). Beyond aviation, Starlink’s portability features enable RV owners and adventurers to stay connected on the go. Emergency responders and disaster relief teams have similarly used Starlink to set up instant communications centers wherever needed. The mobility use cases, including land, sea, and air, are a key differentiator of Starlink.

Government and Military Users: Although not initially a direct commercial focus, Starlink has seen significant uptake by government entities. Military forces (from Ukraine to the U.S. European Command) have deployed Starlink for field communications, as it can be set up in minutes and provides a hard-to-intercept link for data and voice in conflict zones. Starlink is also used in humanitarian operations, for example, supporting connectivity in refugee camps and disaster-struck regions where infrastructure is down. SpaceX now offers Starlink Government service packages, and as mentioned, a higher-security Starshield variant is being developed for defense clients. Moreover, agencies such as FEMA and first responders utilize Starlink to restore communications after hurricanes, wildfires, and earthquakes. (For example, during the September 2024 Hurricane Helene response in the U.S., FEMA deployed dozens of Starlink units to reconnect cut-off communities.) These use cases underscore Starlink’s strategic value when traditional networks are compromised.

Overall, Starlink’s customer base is rapidly diversifying. From connecting a remote school to enabling telemedicine in a village, from powering Netflix on an airplane to guiding drones on the battlefield, Starlink has demonstrated a wide scope of applications that were previously impossible or prohibitively expensive with legacy technologies.

Financial and Commercial Impact

Starlink’s rapid growth has significant financial and market implications for SpaceX and the broader telecom industry. I had already touched on subscribers and revenue, so let’s review pricing and other factors.

Pricing tiers: Starlink’s commercial strategy involves multiple service tiers and pricing models, striking a balance between affordability for consumers and premium offerings for specialized markets. As of 2025, pricing (in the US market) roughly breaks down as follows:

Residential: ~$80–120 per month for typical home use, offering up to ~25–220 Mbps downlink speeds, plus a one-time ~$360 for the standard Starlink dish kit which may be paid in monthly installments (Pricing varies by country; in some regions, monthly fees have been reduced to spur adoption).

Business (Local): $65–$ 540 per month for priority bandwidth designed for businesses, featuring a larger high-performance antenna (with a $1,499 hardware cost) for enhanced resiliency. These plans deliver better throughput during peak times and higher allocation for enterprise data needs.

Mobile (Roam/RV): ~$150–200 per month for portable use (with options for regional or global roaming). These plans allow users to take Starlink with them on vehicles or to different service addresses. Some options offer metered data (e.g., purchase data buckets) for casual use.

Maritime/Global: Tiered plans ranging from ~$250 per month up to ~$2,150 per month for top-tier unlimited use. Hardware for maritime/global (flat high-performance dual-dish kits) costs ~$2,500 for small vessels to ~$10,000 for large ships. This provides 50GB - 2TB of data usage, a huge upgrade over previous services.

Aviation: Custom pricing – Starlink Aviation hardware incurs a high upfront cost (estimated at $ 100,000+ per aircraft for the specialized phased-array antennas). Airlines like Hawaiian provide the service free to passengers, presumably absorbing the cost or treating it as a competitive amenity. Charter operators may pass costs to clients. SpaceX advertises up to 350 Mbps to each equipped aircraft, which is split among passengers.

These pricing tiers indicate Starlink’s two-pronged strategy: to penetrate the mass market for consumers with relatively affordable hardware and monthly fees, while also monetizing high-value commercial segments (such as maritime, enterprise, and airlines) that can bear premium prices for superior connectivity.

The company has demonstrated flexibility in adjusting prices in certain countries with lower purchasing power or where competitor ISP prices are relatively low. Starlink has reduced monthly rates to attract subscribers. Conversely, it charges a premium for “Priority” data or faster speeds, where customers are willing to pay (such as mission-critical business use). This tiered approach helps maximize Starlink’s revenue potential across diverse customer groups.

Capital investment and valuation: SpaceX has invested billions into Starlink’s development and deployment. Musk initially cited a cost of approximately $10 billion to build out the network, though some estimates suggest it could exceed that once the full Gen2 constellation and supporting infrastructure are complete.

To fund this, SpaceX has raised numerous funding rounds; Starlink’s success is a key driver of SpaceX’s soaring valuation, as previously discussed.

Morgan Stanley and other investment banks have modeled Starlink’s valuation in various scenarios. A 2024 Morgan Stanley analysis suggested that Starlink could eventually account for ~75–80% of SpaceX’s revenue and profit generation.

Should it IPO, some analysts project Starlink could command a valuation in the tens of billions or more (for context, rival OneWeb was valued at $3.4 billion in its 2023 merger, and Amazon’s Project Kuiper is entirely within a $1.3 trillion company).

In any case, Starlink has quickly become a major player in the telecom and media sector, with a growing financial profile. Its global revenue streams make it a unique asset that private equity and public market investors are watching closely.

The commercial impact of Starlink extends beyond SpaceX’s coffers. It is disrupting incumbent industries, pressuring telcos and satellite operators to respond (discussed further below), and it has spurred a wave of investment in space-based communications.

SpaceX’s aggressive deployment and first-mover advantage have set a high bar, potentially yielding a winner-takes-most dynamic in LEO broadband. That said, sustaining profitability will require managing costs (including launch, satellite replacement, and customer acquisition) and achieving a sufficient scale in subscriber count.

Thus far, the trajectory is promising: Starlink is already the largest satellite internet provider by users and revenue, and its growth is filling a previously untapped demand for low-latency global broadband. If it continues to execute well, Starlink could become one of the world’s leading internet service providers (by coverage area, if not eventually by subscribers) and a cash engine for SpaceX or any entity spun out of it.

Competitive Landscape

Starlink’s emergence has galvanized competition in both the space and telecom sectors. Key players and competitors include:

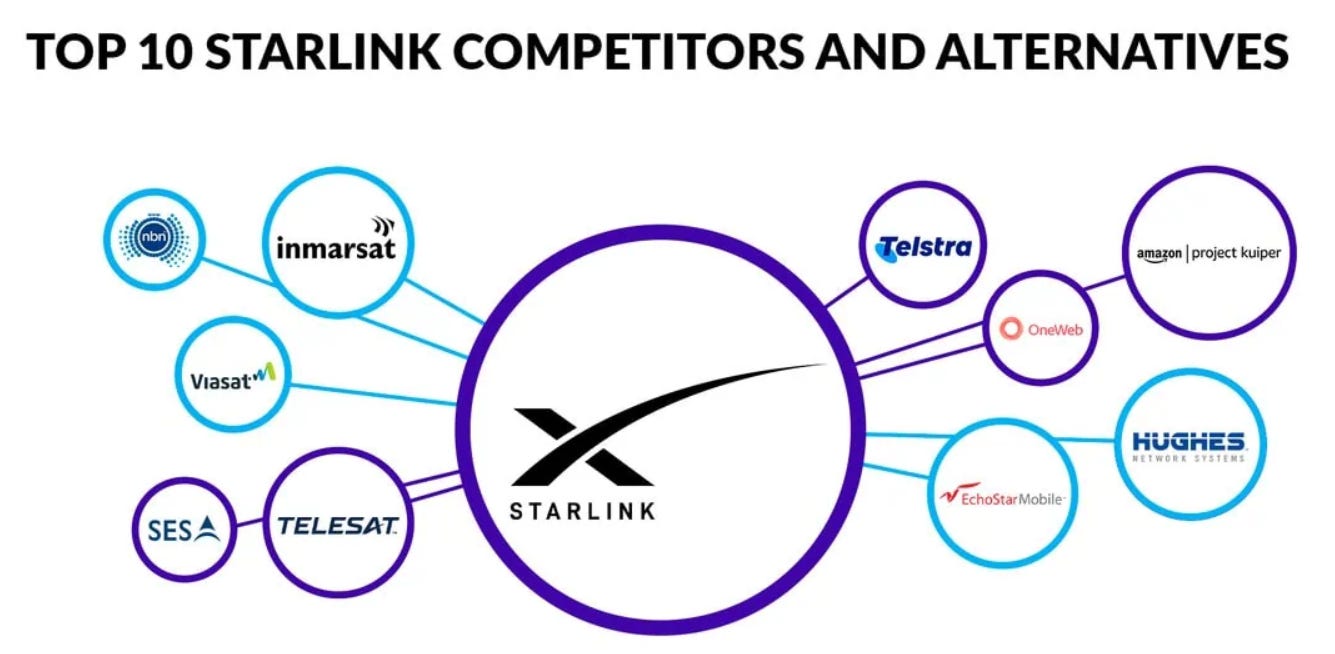

OneWeb / Eutelsat OneWeb: OneWeb, a UK-based LEO satellite internet company and early rival to Starlink, emerged from bankruptcy in 2020 and deployed its 634 satellites by early 2023. Now merged with France’s Eutelsat, OneWeb focuses on serving enterprise, government, and telecom clients, rather than offering direct-to-consumer services. While its constellation is smaller than Starlink’s, operating at a higher orbit (~1,200 km) reduces the number of satellites needed for coverage; however, this results in higher latency (~70 ms vs. Starlink’s ~30 ms). OneWeb emphasizes reliability and partnerships, particularly with the telecom and transportation sectors, aiming to complement or provide an alternative to Starlink, especially for governments concerned about their reliance on U.S. systems.

Amazon’s Project Kuiper: Project Kuiper, backed by Amazon with a $10 billion investment, is set to compete heavily with Starlink. It has FCC approval for a 3,236-satellite constellation and has recently launched its first two test satellites, with a goal of deploying half by mid-2026. Kuiper plans to start service in select regions by late 2025 and aims to leverage Amazon’s consumer ecosystem and cloud infrastructure. The competition is expected to be intense due to both companies' strong financial backing and technical capabilities, though Starlink currently enjoys a 5-year lead and a large customer base.

Traditional Satellite ISPs (GEO operators): Before Starlink, satellite internet was primarily provided by geostationary (GEO) companies, such as Viasat and Hughes, serving rural North America, maritime, and aviation markets. While they offered decent speeds (up to ~100 Mbps), their high latency (~600 ms) limited competition with Starlink's low-latency service. In response, GEO providers are launching new high-capacity satellites and focusing on in-flight Wi-Fi and government contracts. However, Starlink is taking market share from traditional providers. Unusual partnerships have formed, such as Hughes and Dish investing in OneWeb, as GEO firms seek to adapt. Despite regulatory lobbying to slow LEO deployments, GEO providers are likely to lose significant consumer internet market share over time, retaining advantage only in niche scenarios.

Other Emerging Constellations: Several initiatives are emerging alongside OneWeb and Kuiper. Telesat’s Lightspeed aims for a LEO constellation focused on enterprise markets, but funding delays have pushed its launch target to 2026. AST SpaceMobile plans to offer direct satellite-to-cell phone service for areas that are currently unserved, focusing on voice and text services rather than high-speed broadband. China is developing its own mega-constellation, GuoWang, with over 12,000 satellites for both independent and military use, while other governmental projects, such as the EU's IRIS² and Russia's Sphere, are in their early stages. The next few years are likely to bring increased competition, benefiting consumers with more options and potentially lower prices.

Geopolitical and Defense Relevance

Starlink’s decentralized internet service has significant geopolitical implications, particularly evident during Russia’s 2022 invasion of Ukraine. When communication was disrupted, SpaceX shipped Starlink terminals that quickly restored connectivity for the government, military, hospitals, and civilians.

This was crucial for encrypted communications and intelligence sharing, with one officer stating that Starlink was as essential as weaponry. By late 2022, over 20,000 terminals were active, funded through crowdfunding and donations. Initially, SpaceX covered most of the costs ($20M a month), but later, the U.S. Department of Defense and the EU formalized funding.

By mid-2023, Starlink in Ukraine was under a Pentagon contract, highlighting its role as critical infrastructure in conflict. Controversy arose when SpaceX limited some usage to prevent escalation, revealing tensions between corporate control and military needs. In response, SpaceX announced Starshield, a service for sensitive government use under U.S. control.

Starlink has been involved in several geopolitical issues beyond Ukraine. During the 2022 protests in Iran, activists used Starlink kits to bypass government internet shutdowns, prompting a response from the Iranian regime. The service was also utilized in Myanmar by dissident groups facing network disruptions.

In India, during unrest in Manipur in 2023, insurgents acquired Starlink units to circumvent a government blackout, despite the Indian government not having authorized their commercial use. Some countries, such as China, Iran, and Russia, have banned Starlink receivers or made the unauthorized use of them illegal, although enforcing these bans can be challenging.

The success of Starlink has alarmed rival powers. Russian military thinkers view it as a significant force multiplier for the U.S. and allies, with efforts to jam its signals in Ukraine proving largely ineffective. SpaceX has fortified Starlink’s defenses, demonstrating resilience against cyber and electronic warfare attacks.

China, regarding Starlink as a national security threat, has considered options to neutralize it during wartime, including anti-satellite missiles and cyber hacks. In 2023, a U.S. Space Force official highlighted China’s development of tools to target satellites, including those used by Starlink.

In response, Western militaries are exploring their own satellite constellations, raising concerns about the potential for conflict over commercial systems. This development complicates international law, as attacking Starlink could entangle the U.S. in the defense of a private entity's assets.

Regulatory and diplomatic challenges are emerging with Starlink’s satellite internet service. Many countries prefer to control local telecom services, which led India in 2021 to halt Starlink pre-orders due to licensing issues. Other nations have delayed approvals or mandated local partnerships, as seen in Nigeria.

Export controls also complicate matters, as U.S. rules affect service in sanctioned countries such as Iran and North Korea, where special licenses are required. The European Union has largely supported Starlink; however, concerns about spectrum interference and competition with the upcoming IRIS² constellation have sparked regulatory discussions.

Additionally, astronomers worldwide are advocating for measures to reduce Starlink's impact on the night sky, prompting SpaceX to implement sunshades and lower satellite brightness. [In 2024, I observed a Starlink satellite with my naked eye fly overhead in a remote area with zero light pollution and a new moon. I can attest to the issue.]

Starlink has emerged as a strategic asset with significant geopolitical implications. It represents private, global infrastructure that operates outside the control of any single government. For the U.S. and its allies, Starlink provides a resilient communications layer now being integrated into Pentagon architectures.

For authoritarian regimes, it serves as a potential means of information freedom that is difficult to block. This dual-use nature complicates diplomacy, raising questions about whether Starlink satellites are civilian infrastructure or military assets.

As nations aim to develop their own capabilities to reduce dependence, expect more discussions on norms for engaging commercial space systems during conflicts. Starlink's role in Ukraine has underscored the critical importance of space-based internet, highlighting the consequences of falling behind in this area.

Forward-Looking Analysis and Implications

Starlink is poised to be a transformative force in global connectivity, with ripple effects across telecommunications, technology, and even societal resilience. Here are several forward-looking considerations on how Starlink could reshape the landscape:

1. Reshaping Global Connectivity and Digital Inclusion: Starlink’s expansion aims to provide high-speed internet globally, potentially bridging the digital divide. Areas with poor infrastructure, such as rural Appalachia and remote villages, will greatly benefit from satellite broadband, enabling entrepreneurship, online education, and telemedicine.

However, the initial cost of ~$360 for hardware combined with higher monthly fees may limit access primarily to more affluent users. Over time, costs will decrease, allowing poorer communities to gain access too.

SpaceX is already partnering with rural schools in Chile and Brazil and working with authorities in the U.S. and Australia to connect underserved areas.

2. Forcing Evolution in the Telecom Industry: The telecom sector is taking notice of Starlink and upcoming LEO constellations, which pose a competitive challenge, particularly in underserved markets. Traditional telecoms may respond through collaboration or innovation, such as partnerships where mobile operators use Starlink for backhaul, accelerating 4G/5G rollouts in remote areas.

Early examples include OneWeb's deals with AT&T and Starlink’s partnership with T-Mobile to enable direct-to-handset satellite messaging, thereby enhancing connectivity in areas with poor coverage.

However, Starlink poses a threat to telcos’ satellite broadband subsidiaries and rural ISPs. Accenture warned that telcos, particularly in emerging markets, must adapt or face decline, potentially leading to regulatory lobbying against Starlink or attempts to bundle services with satellite offerings.

Ultimately, Starlink could prompt telecom providers to enhance their services and pricing as connectivity becomes more commoditized, ultimately benefiting consumers and enterprises with increased choices and innovations in connectivity.

3. New Market Opportunities and Spin-Off Potential: If Starlink maintains its growth trajectory, it could launch new offerings, such as direct-to-device connectivity and a potential smartphone tailored for satellite use. The company might also explore IoT solutions by introducing lighter, cost-effective terminals or updates for connecting devices globally.

Additionally, Starlink could enter the enterprise cloud connectivity market by bundling satellite links with cloud services for remote computing, leveraging partnerships with Microsoft Azure and Google Cloud.

If SpaceX spins out Starlink for an IPO, it would likely attract significant investment interest, while also needing to ensure subscriber growth and profitability. This could potentially lead to partnerships or acquisitions in the telecom sector.

4. Geopolitical Connectivity and “Space Networks” Competition: Starlink's success is prompting other nations to develop their own satellite systems for digital sovereignty. Over the next 5–10 years, we may see a fragmented landscape, with the U.S. utilizing Starlink and potentially Amazon, China relying on its state-run alternatives, and Europe utilizing IRIS² for regional users.

With multiple constellations, interoperability will be crucial. Will devices seamlessly switch between networks? Some countries might restrict Starlink in favor of their own or allied systems, especially if it's seen as U.S.-aligned.

The Pentagon’s contract with Starlink suggests an increasing military reliance on commercial satellite communication, potentially limiting the need for government satellites while also creating a dependency on SpaceX.

5. Technical and Regulatory Challenges Ahead: Looking forward, Starlink’s growth is not without hurdles. One major challenge is orbital congestion and space sustainability. With plans for 12,000 or even 42,000 Starlink satellites, plus thousands from competitors, concerns have arisen about the risks of space debris and collisions.

Regulators like the FCC and international bodies (ITU, UNCOPUOS) will likely impose stricter requirements on debris mitigation, satellite brightness, and safe operations. SpaceX has attempted to be proactive in that its satellites deorbit at the end of their life and autonomously avoid collisions using tracking data.

However, as the skies become increasingly crowded, coordination among operators will be vital. Starlink’s ability to maintain a high launch cadence also depends on launch technology: SpaceX eventually needs Starship (its new heavy rocket) to be operational to deploy the larger Gen2 satellites efficiently.

Delays or issues with Starship could bottleneck constellation upgrades. Financially, if a global recession or market saturation hits, Starlink might need to moderate its expansion or face price competition from rivals. Another factor is customer experience, as more users join, Starlink must manage network capacity to avoid oversubscription, which can slow speeds.

This may involve launching even more satellites or expanding ground infrastructure. On the regulatory side, spectrum battles will intensify: Starlink uses Ku- and Ka-band frequencies (and is experimenting with E-band). Terrestrial 5G operators and others are eyeing some of the same bands, so Starlink will continue to be involved in negotiations and disputes over airwaves.

Internationally, securing landing rights (permission to operate) in each country is an ongoing task; some places will have political roadblocks. Nonetheless, given SpaceX’s track record, Starlink is likely to meet many of these challenges with engineering solutions and sheer scale (e.g., launching replacements faster than failures occur, etc.).

6. Long-Term Vision – A New Telecom Paradigm: Zooming out, Starlink suggests a new connectivity paradigm where space-based networks may supplement or replace parts of terrestrial networks. In a decade, a significant portion of global internet traffic, particularly in developing regions, could rely on satellite constellations, while urban areas focus on fiber networks.

This shift might allow countries to prioritize core infrastructure and local distribution, using satellites for rural coverage. In extreme cases, Starlink could offer a direct alternative to national internet service providers (ISPs), raising questions about regulation and the balance of competition. A multi-layered internet (ground and space) could enhance resiliency, allowing connections via satellites even during disasters that cut other infrastructure.

Conclusion

Starlink’s journey is just beginning, and it is already making a remarkable impact on both industry and society. It has proven that a large-scale space-based internet is not only feasible but also financially viable. By pushing competitors to innovate and inspiring nations to craft new strategies, Starlink is reshaping the landscape. It has brought critical connectivity to everyday life, from rural homes to essential support in wartime Ukraine and natural disasters.

For senior business leaders and investors, Starlink embodies the dawn of a new sector bursting with potential for high returns and strategic value. Yet, it also presents a disruptive challenge, poised to redefine existing business models in telecommunications, media, and technology. As Starlink and its competitors evolve, we can anticipate faster internet access for more people and groundbreaking services that leverage satellite connections, all while fostering a convergence of terrestrial and satellite communication infrastructures.

The strategic implications are profound: control of information and connectivity may increasingly lie with those who oversee these satellite constellations. Currently led by SpaceX, a private company with an ambitious vision, this future may soon include other networks.

Staying attuned to Starlink’s evolution will be vital for anyone interested in the future of connectivity, global markets, and the intersection of technology and geopolitics. The sky is not just a limit; it has transformed into a bustling, competitive marketplace, with Starlink at the forefront, turning what was once science fiction into a vibrant reality.

Sources

Insights and data in this newsletter are drawn from publications and research, including:

SpaceX / Starlink Official Communications

Starlink.com product and pricing pages

SpaceX press releases and satellite deployment updates

Elon Musk interviews and statements (e.g., Twitter, earnings calls)

U.S. Government and Regulatory Filings

FCC filings and licenses for Starlink (public records via FCC.gov)

U.S. Department of Defense contracts for Starlink use in Ukraine

Federal Aviation Administration (FAA) and National Telecommunications and Information Administration (NTIA) public documents

Business & Financial Reporting

Wall Street Journal – Reporting on Starlink subscriber growth, revenue, and profitability

Bloomberg – SpaceX valuation, Starlink financial models, IPO speculation

CNBC – Interviews with SpaceX executives, updates on Kuiper and OneWeb

The Information – Internal Starlink revenue documents (2023 leak)

Industry & Space Sector Analysis

SpaceNews, Ars Technica, The Verge – Satellite launch tracking, policy debates, engineering updates

Quilty Analytics – Satellite broadband market forecasts and LEO constellation comparisons

Advanced Television – Maritime and in-flight connectivity case studies

Defense & Geopolitical Think Tanks

Center for Strategic and International Studies (CSIS) – Starlink in Ukraine, militarization of LEO

Secure World Foundation – Policy and space sustainability reports

U.S. Space Force and Pentagon briefings on Starshield and space communication systems

Academic and International Reporting

Harvard Kennedy School’s Belfer Center – Satellite cyber and geopolitical risk commentary

International Telecommunication Union (ITU) – Global spectrum coordination for satellite operators

Reports from India’s Ministry of Telecom, EU Commission (IRIS² plans), Russian and Chinese defense publications commenting on Starlink’s strategic implications