Leadership Under Pressure: Lessons from Carrie Wheeler’s Tenure at Opendoor

(5 Min Read)

Hi, it’s David Lambert, and welcome to The Business Growth Blueprint, my weekly newsletter where I delve into the critical elements of business growth—strategy, leadership, operations, and the technologies shaping tomorrow. Subscribe to join 2,300+ readers who get The Business Growth Blueprint delivered to their inbox every week.

Introduction

Opendoor isn’t a household name for most, but in real estate and tech circles, it was once one of Silicon Valley’s brightest stars. Founded in 2014, the company pioneered iBuying, a model in which it buys homes directly from sellers, makes minor repairs, and resells them quickly. The pitch was speed and certainty for homeowners; the risk was carrying billions of dollars in housing inventory.

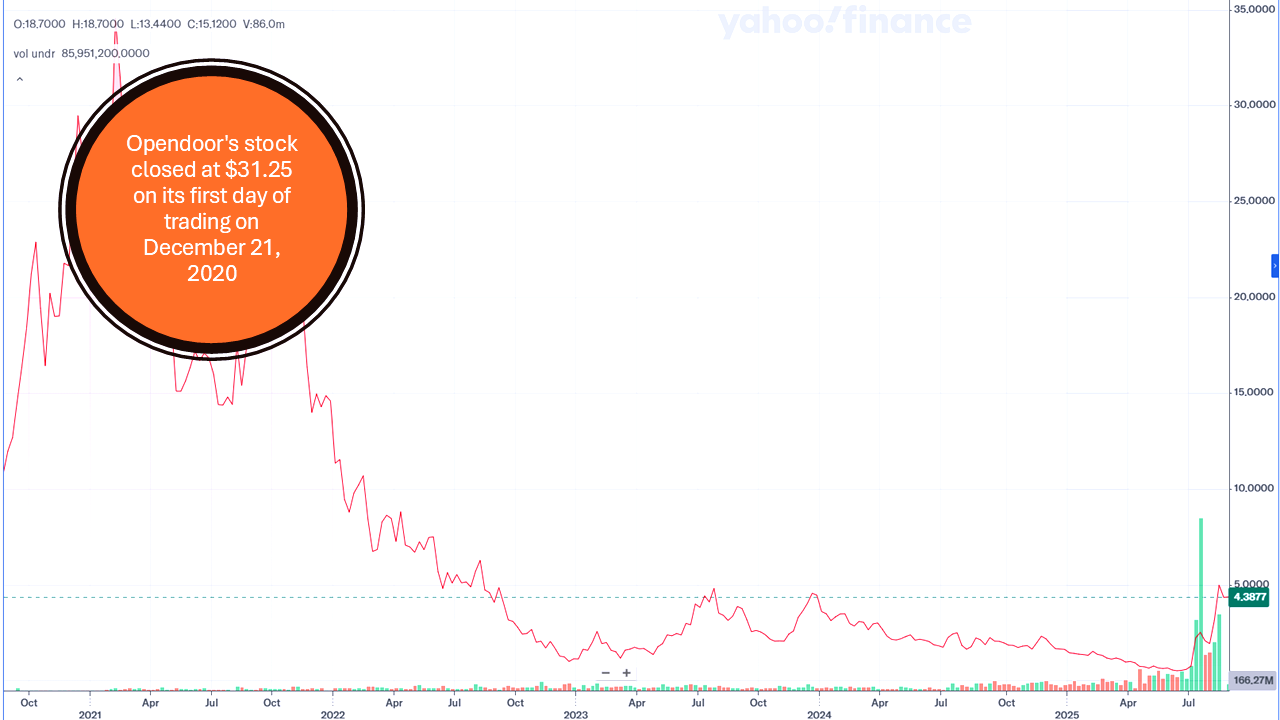

That model thrived in a world of low interest rates and rising home prices. But when mortgage rates spiked and the housing market cooled, the economics collapsed. At the center of this storm was Carrie Wheeler, Opendoor’s former CFO, who became CEO in late 2022. Her three-year run offers leaders a case study in navigating crisis and the limits of execution without a narrative.

What interested me in this story is that, according to Carrie, she was doing well, but stepped down on August 15th, 10 days after their recent earnings announcement. We stopped the bleeding. We restructured the business, rebuilt an exceptional leadership team, set a bold vision for long-term value creation, and reshaped the company for the future – all against the backdrop of one of the toughest real estate markets on record. We went from $1 billion in losses when I took over, to announcing our first quarter of positive EBITDA in three years this past quarter.

She was under pressure. Activist investors were dissatisfied with the company's progress and the lack of a clear roadmap for transforming Opendoor into an AI-first real estate platform. We want a comprehensive plan articulated on how she plans to take the 51-cent company she’s presided over for 2.5 years to the heights of $200/share in 3 years. We have a plan for that. Does she agree? Is she the one to take us there?

In the end, Wheeler’s departure underscores a brutal truth: survival alone isn’t enough. Investors, employees, and customers don’t just want stability; they want belief in a future worth betting on. For leaders, the Opendoor story is a reminder that numbers can buy you time, but only a compelling vision earns you staying power.

Let’s dig in.

Please feel free to comment and subscribe - it’s free!

The Setup She Inherited (Dec 2022)

When Carrie Wheeler stepped into the CEO role in December 2022, she inherited a company in freefall. Opendoor had just reported a staggering $1.35 billion net loss for the year, including a $737 million write-down on its housing inventory, a direct result of plunging home values and the company’s exposure to unsold properties. To stop the bleeding, Opendoor executed an 18% workforce reduction, a painful move that signaled both the depth of the crisis and the urgency to preserve cash.

Making matters worse, the external environment was turning against her. The housing market, once the foundation of Opendoor’s growth, had shifted dramatically. By October 2023, the 30-year mortgage rate spiked to 7.79%, the highest in more than two decades. Demand froze, affordability collapsed, and the company’s once profitable flipping model, built on cheap capital and fast resales, was suddenly underwater.

Naturally, new leaders don’t get to choose ideal conditions, but they also don’t get to sit out the storm either. Her mandate was clear: stabilize the business, restore investor confidence, and chart a course forward.

Reset Before Rebuild (2023)

In 2023, Wheeler’s focus shifted from bold reinvention to survival. Her playbook was straightforward: cut costs, slow the bleeding, and start rebuilding credibility with investors and employees alike.

This meant making more painful moves, most notably an additional 22% workforce reduction in April 2023, which resulted in the elimination of roughly 560 jobs. At its peak, Opendoor employed 2,816 people in 2021. The company was now 40% smaller.

The financial results reflected that pivot. Revenue collapsed 55% year-over-year to $6.95 billion, a stark reminder of how quickly the housing downturn had undercut the business model. At its 2022 peak, the company had revenue of $15.57 billion. However, and this is a key point, Opendoor has never posted a full-year profit since its founding in 2014.

Yet, there was a glimmer of progress as net losses narrowed to $275 million. It wasn’t a story to celebrate on Wall Street, but it showed Opendoor could, at the very least, buy time.

On the surface, Wheeler’s tenure showed progress: losses narrowed, costs were contained, and the company survived a brutal housing cycle. But beneath the headlines, the reality hadn’t changed.

As I pointed out, Opendoor has never turned a profit since its founding. Was this genuine progress, or simply buying time in the hope that a better market would rescue the company? Where was the Board in all of this? As leaders, we have all been in challenging situations, but was this turnaround even achievable?

Partner, Don’t Disrupt (2024)

By 2024, Carrie Wheeler shifted Opendoor’s playbook from trying to disrupt the traditional housing system to working within it. The most symbolic move came with an unlikely alliance: a partnership with Zillow, once a bitter iBuying rival. Rather than battling for dominance, Opendoor positioned itself as a platform that could integrate with agents and partners, signaling a more collaborative future.

But collaboration didn’t fix the fundamentals. Revenue slipped again to $5.2 billion, continuing the downward slide from its 2022 peak of $15.6 billion. Profitability remained elusive with adjusted EBITDA at –$142 million, and another 17% workforce reduction underscored the company’s struggle to stay lean.

The hard truth is this: you can’t cut your way to growth. Cost reductions may buy time, but they rarely unlock the future. When Howard Schultz slashed costs at Starbucks in 2008, he paired it with reinvestment in store quality and digital engagement, fueling a resurgence. Cuts cleared the runway, but a clear pivot created lift.

Opendoor, by contrast, was still searching for that pivot. The company had managed to stay afloat, but staying alive isn’t the same thing as moving forward. Without a path to profitability or a story that could rally belief, Wheeler’s strategy looked less like a setup for a turnaround and more like an attempt to stave off the inevitable. Again, I ask…where was the Board?

A Small Win, Then a Pivot (2025)

By mid-2025, Carrie Wheeler finally got the win she’d been chasing. In Q2, Opendoor posted positive adjusted EBITDA of $23 million, the first real proof that the model could actually work under tighter discipline. For a moment, it looked like her playbook had paid off.

But proof isn’t the same as promise. Investors didn’t just want a company that could grind out survival; they wanted a leader who could inspire belief, a bold narrative, the spark of a founder, not the careful discipline of an operator.

Wheeler delivered stability, but she never convinced the market she could provide growth. As mentioned, ten days after announcing the latest results, she was out. The verdict was immediate: shares jumped on news that CTO Shrisha Radhakrishna would take the reins as interim CEO, signaling Wall Street’s appetite for vision over caution.

In the end, Wheeler bought Opendoor time but not conviction. The company was leaner, its losses narrower, and its model no longer in freefall. Yet conviction, the belief that this was a business worth betting on for the long haul, never followed. That raises a more complicated question: Were the expectations placed on her ever realistic?

The board and the market were not only asking for stabilization, they wanted a turnaround story that could lift a fifty-cent stock into triple digits, and they wanted it fast. They demanded profitability and a bold new narrative simultaneously, in the midst of one of the toughest housing markets in decades.

Was that true accountability, or was it Mission Impossible? For leaders, the lesson may be that execution can steady the ship, but when investors demand reinvention at startup speed, even survival can appear to be failure.

Conclusion - Leadership Lessons

Here’s what leaders can take away from Wheeler’s run at Opendoor:

1. Context matters more than capability. You can be a strong leader and still be the wrong fit for the moment. Wheeler was steady, disciplined, and sharp on operations. But Opendoor did not just need stability; it required a bold story to convince the market that the future was worth betting on. Even the right skills can look mismatched in the wrong phase of a company.

2. Expectations must be grounded in reality. Wheeler was tasked with stabilizing a company that had never been profitable while also convincing the market that it could suddenly become a high-growth story. That may have been less a leadership challenge and more an impossible assignment. Leaders should strive for clarity on what success actually entails, and boards and investors must ensure that those goals are achievable. Unrealistic expectations can doom even the most capable leader.

3. Execution buys time, vision buys the future. Wheeler did the hard work of cutting losses and buying breathing room. But time without belief does not last long. Investors wanted more than survival; they wanted the next act. Leaders need both sides of the equation: discipline to protect today and vision to sell tomorrow.

4. Narrative is not optional. In markets this volatile, the story is as important as the numbers. Silence creates doubt, and doubt kills confidence. Wheeler discussed stabilization but never clearly outlined what came next. For leaders, the takeaway is simple: narrative is not fluff, it is strategy.

5. Exit with intention. Not every chapter ends with a win, but how you leave still matters. Wheeler stepped aside quickly, remained as an advisor, and ensured a smooth transition. Leaders may not control the outcome, but they can control the handoff, and that can make all the difference for the people left behind.

Sources

Insights and data in this newsletter are drawn from publications and reporting, including:

Eric J. Savitz, “Opendoor CEO Resigns. The Meme Stock Is Getting New Leadership,” Barron’s, Aug 15, 2025.

MarketWatch Staff, “Opendoor’s Stock Is Rocketing Again. What Can Make It Keep Going?” MarketWatch, Aug 15, 2025.

Dominick Reuter, “Opendoor Is Surging Again After July’s Meme-Like Rally. Here’s Why,” Business Insider, Aug 2025.

Financial Times, “Opendoor Reports First Adjusted EBITDA Profit Since 2022,” Aug 2025.

Nasdaq News, “Opendoor Q2 2025 Earnings Report,” Aug 2025.

AInvest, “Opendoor: A Problem or a Cautionary Tale for Real Estate Tech Investors?” Aug 2025.

AlphaSpread, “Opendoor CEO Carrie Wheeler Resigns Following Investor Pressure, Stock Surges,” Aug 2025.