Brand Equity: A Balance-Sheet Asset You Rent From Customers

(5 Min Read)

Hi, it’s David Lambert, and welcome to The Business Growth Blueprint, my weekly newsletter where I delve into the critical elements of business growth—strategy, leadership, operations, and the technologies shaping tomorrow. Subscribe to join 2,300+ readers who get The Business Growth Blueprint delivered to their inbox every week.

Introduction

Throughout my career, I’ve experienced the power and risks associated with brand equity. I helped lead a company through a complete rebrand, and earlier in my career, I had just joined Accenture during its historic transition from Andersen Consulting.

Those experiences taught me that brand equity isn’t a logo or a color palette. It is the trust, recognition, and meaning customers lend you. And when that bond breaks, the financial and reputational damage is real. We’ve seen it play out recently: Cracker Barrel reversed a $700M modernization push after a logo change sparked outrage, and Bud Light lost its top spot in U.S. beer sales after a values-signaling misstep reshaped the market.

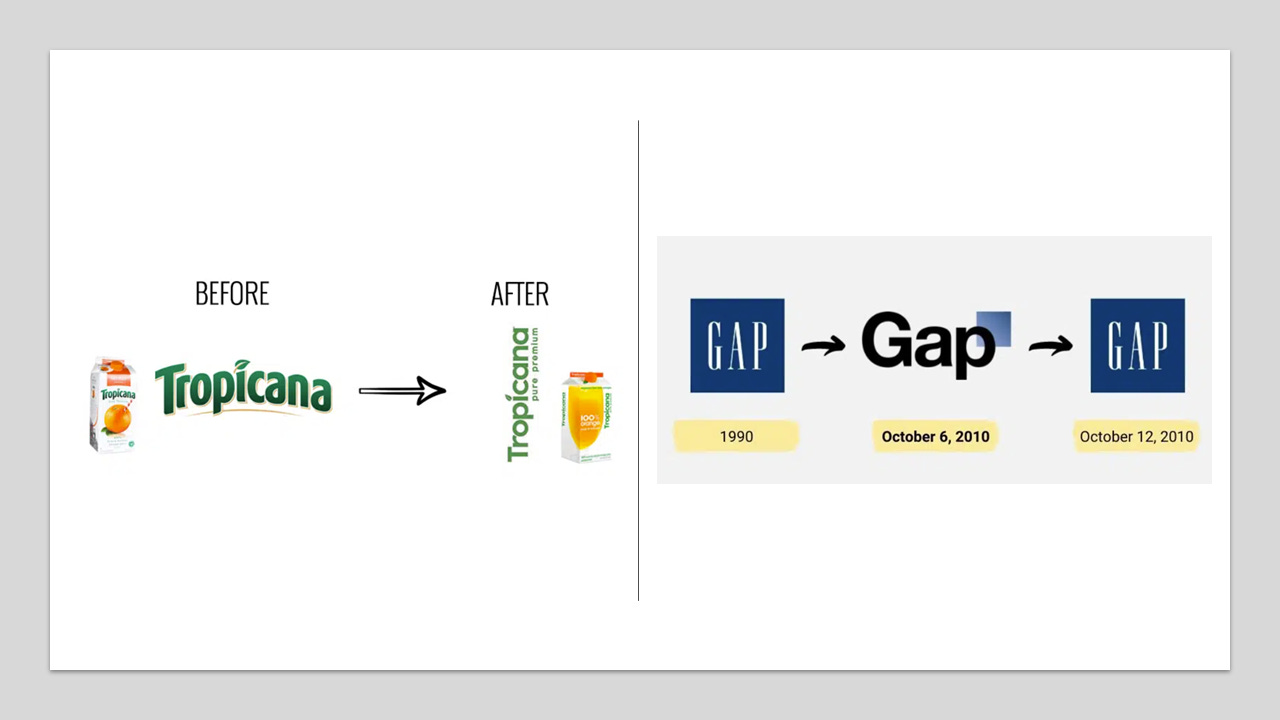

The same story has played out before: Tropicana lost 20% of sales in weeks after a packaging redesign, Gap scrapped its new logo within days after a customer revolt, and Facebook’s shift to “Meta” remains a live case study in equity impact.

These are not just marketing blunders. They are reminders that brand equity is a rented asset, one that leaders must build deliberately, protect fiercely, and manage with discipline. In this, I’ll share the framework I’ve used to think about brand equity and the playbook leaders can lean on when meaning, symbols, or values come under fire.

Let’s dig in.

Please feel free to comment and subscribe - it’s free!

What Brand Equity Really Is

Brand equity is one of those concepts that sounds abstract until you see it at work. It is the extra value customers give you: recognition, trust, and mental availability. It is why Apple can charge hundreds more for a phone with nearly the same hardware as its competitors, or why Costco’s Kirkland label can outsell national brands, because people believe in what the name represents.

Two of the most practical ways leaders have learned to make sense of brand equity come from marketing scholars David Aaker and Kevin Keller.

Aaker’s model says brand equity is built through five pillars: loyalty, awareness, perceived quality, associations, and proprietary assets (things like trademarks or distribution agreements). These are the levers a company can deliberately pull to strengthen its brand. For example, when you keep customers coming back, build awareness through marketing, or ensure your product is seen as reliable, you are compounding equity.

Keller’s framework, known as Customer-Based Brand Equity (CBBE), examines it from the consumer’s perspective. His “pyramid” illustrates how brands evolve from a simple identity (people know you exist) to meaning (people understand what you stand for), to responses (they like and trust you), and finally to resonance, where customers advocate for you, defend you, and refuse to switch. Think of Harley-Davidson riders tattooing the logo on their arms: that is resonance.

And this is not just theory. Equity shows up in the numbers. Perceptions of brand value can significantly impact stock prices within a single trading session. Companies with deep equity can take a hit, whether it is a bad quarter or a PR stumble, and recover faster than weaker competitors.

The leader’s takeaway is simple. Equity is not a logo. It is not a tagline. It is a system of expectations you have to meet across every product, every place, every moment in time. Break that system, and you find out quickly who really owns the equity.

Cracker Barrel: When Heritage Is the Product

This summer, Cracker Barrel took a bold step: a complete modernization, including a sleek, minimalist logo that no longer relies on the “Old Timer” image of the barrel. The redesign was meant to appeal to younger diners as part of a $700 million revamp. But the response was swift, loud, and unforgiving.

Within days, social media exploded:

“You kicked Uncle Herschel to the curb. Now you are paying the price. Own it and stop making excuses.”

“It takes away from heritage. When you're 81 years old, you kind of remember the way the place started.”

Politicians and pundits joined in. Some urged the chain to revert to the old logo, calling it “the ultimate poll” and a PR opportunity. As backlash mounted, shares plunged nearly 12%.

Just days after going live, Cracker Barrel blinked. The company issued an apology, saying, “We could’ve done a better job sharing who we are,” and then restored the classic “Old Timer” mark.

So what happened here? First, they misread the meaning market. For Cracker Barrel, that man-by-the-barrel isn’t a symbol; it is the story. The porch, the fireplace, the knick-knacks, these aren’t accessories; they’re the identity customers have embraced for generations. Stripping them out broke the emotional connection.

Second, they overlooked the risk of politicization. In today’s polarized climate, a logo isn’t just a logo; it can become a symbol in a broader cultural fight. And yes, that means backing into a controversy and having to turn on a dime.

Here’s the leadership takeaway: In experience-based categories where nostalgia is the product, symbols aren’t just branding; they are the product. Any change must be staged, evidence-based, and deeply rooted in customer meaning. Otherwise, what appears to be progress can feel like a betrayal.

Bud Light: The Aftershocks of Values Signaling

Bud Light’s 2023 controversy was more than a headline. It was a shock to the system that reshaped the entire U.S. beer market. Within a year, Bud Light had fallen from its long-held number one spot to third place, behind Modelo and Michelob Ultra (Anheuser-Busch InBev owns both brands). By 2025, Ultra’s growth kept accelerating even as the overall beer category softened, leaving Bud Light’s recovery incomplete and uncertain.

What makes this case so instructive is how the crisis spread. The problem could not be solved with one clever ad or a quick apology. The “fix” required portfolio-level adjustments: shifting dollars to Ultra, revising SKUs and pricing, and leveraging brands that had more precise positioning and momentum. Contagion in consumer markets is a real phenomenon, and leaders cannot always directly stabilize a wounded brand. Sometimes they have to defend the castle by reinforcing another wall.

Category dynamics made the situation even tougher. Beer is not a growth industry in the United States. It is flat to declining, which means lost share is far harder to win back. Competitors seized the vacuum. Modelo, supported by strong distribution and demographic trends, surged ahead. Bud Light was not just fighting to regain ground. It was fighting in a market where every inch is contested.

The third lesson is the most sobering. Crises of this scale do not return to the old baseline. They create a new equilibrium. Bud Light is unlikely to regain its former dominance because consumer habits, perceptions, and loyalties have shifted. Once the category reorganizes, the latest mix tends to stick.

For leaders, the Bud Light story serves as a reminder that values-driven actions have lasting consequences. They ripple through portfolios, reshape categories, and reset expectations. The task is not to hope for a return to normal. The task is to build a new playbook for the new reality.

Rapid Equity Erosion: Meta’s Identity Crisis

In 2021, Facebook made one of the boldest brand pivots in corporate history, rebranding itself as Meta. The move was meant to signal a future beyond social media, centered on the “metaverse,” a virtual world where work, play, and connection would merge. But instead of expanding the brand’s relevance, the change exposed how fragile brand equity can be when leaders misread what the market actually values.

For nearly two decades, Facebook had become shorthand for social connection. Its name and blue square weren’t just branding; they were cultural infrastructure. Billions of people worldwide use it daily to communicate, share, and advertise. Overnight, that familiarity was replaced by a new name few understood and a concept, “the metaverse,” that felt abstract, expensive, and disconnected from reality.

The timing couldn’t have been worse. The rebranding came amid privacy scandals, whistleblower revelations, and a decline in trust. Instead of reframing the company as visionary, it made the move look like an escape hatch. Investors fled, advertisers paused, and within a year, Meta’s market value had fallen by more than $600 billion.

The lesson: you can’t rebrand your way out of a credibility problem, and you can’t stretch your brand narrative further than your audience’s imagination.

The Leader Playbook: How to Protect and Compound Brand Equity

The best time to protect brand equity is before you need to. By the time a crisis hits, trust is already withdrawing faster than you can deposit.

1. Build the buffer.

Map your identity assets: the symbols, rituals, and founder stories people actually care about. Test what they mean to real customers. Every redesign or message has an equity price tag. Know what you’re spending before you swipe.

2. Draw your lines.

Create a values matrix that defines what you’ll speak on, what you’ll stay silent about, and where the gray areas live. Pressure-test those choices with employees, customers, and partners so you aren’t discovering your boundaries in the middle of a storm.

3. Watch the early signals.

Share of Search, sentiment velocity, and excess share of voice all move before revenue. Treat them like smoke detectors. And assume even neutral actions can get political. Scenario plan for who responds, how, and how fast.

4. When a crisis hits, act fast and act visibly.

If stakeholders believe you acted with intent or negligence, words won’t fix it; actions will. Show change, narrate continuity, and remind people what’s staying the same so they don’t feel abandoned. Utilize your portfolio wisely by reallocating funds to cleaner brands while the damaged ones recover.

5. Rebuild the moat.

After the fire, double down on distinctiveness. Flood the market with your assets: packaging, codes, and rituals. Maintain a higher share of voice than share of market for at least a year. Then codify the lessons. Put heritage assets under review, run red-team drills, and make crisis muscle part of your operating system.

Because in the end, brand equity doesn’t heal on its own. It compounds only when leaders turn every scar into a strategy.

Conclusion: The Stewardship of Meaning

Brand equity is not a possession. It is a license granted by the market renewed daily through relevance, consistency, and trust. Leaders don’t own it; they manage it on behalf of the customers who built it with their attention, belief, and loyalty.

Cracker Barrel, Bud Light, Tropicana, Gap, and Meta all reveal the same truth. When you tamper with what people recognize or believe, you are not just changing aesthetics; you are renegotiating the emotional contract that underwrites your business. The consequences show up fast in the balance sheet and linger even longer in the mindshare you lose.

For boards and operators, the imperative is discipline.

Treat symbols and rituals like product IP. They carry economic value because they carry meaning. Protect them with the same rigor you protect patents or formulas.

Expect permanent shifts in share after identity shocks. Market trust rarely snaps back to its prior equilibrium. Plan for the new baseline, not the old one.

Measure leading indicators. Share of Search, sentiment velocity, and cultural relevance scores often precede revenue growth. Treat them as early-warning systems, not marketing vanity metrics.

Govern change. Major brand or values decisions should clear the same level of diligence as capital investments. Brand equity is intangible capital, but it is genuine.

Ultimately, brand equity is the compounding interest of trust. It grows quietly when you keep promises and erodes violently when you break them. The companies that endure understand that every choice, every redesign, statement, or campaign, whether it adds a deposit to that account or triggers a withdrawal, is a crucial decision.

The most resilient brands are those that remember what their customers never forgot: equity is built over decades and lost in days.

Sources

Insights and data in this newsletter are drawn from publications and reporting, including:

Cracker Barrel reversal, investor reaction, and company statement: PBS NewsHour; AP; Nation’s Restaurant News; Cracker Barrel site; CBS News. (PBS, AP News, Nation’s Restaurant News, Cracker Barrel, CBS News)

Bud Light market share shifts and Michelob Ultra momentum: WSJ; Forbes; Reuters/NIQ trend context; MarketWatch. (Wall Street Journal, Forbes, Reuters, MarketWatch)

Brand equity theory: Keller (CBBE); Aaker components. (Duke People, ResearchGate)

Crisis communication: Coombs’ SCCT and product-harm research. (SpringerLink, PMC)

Predictive metrics: Share of Search (IPA/EffWorks); ESOV (Binet & Field). (IPA, maynardpaton.com)